The Canadian dollar lost close to a cent last week, as USD/CAD closed above the 1.12 line for the first time since March. This week’s highlights are Building Permits and Employment Change. Here is an outlook on the major market-movers and an updated technical analysis for USD/CAD.

Canada’s trade balance posted a deficit for the first time in three months. In the US, a sparkling Nonfarm Payrolls weighed on the shaky Canadian dollar.

[do action=”autoupdate” tag=”USDCADUpdate”/]USD/CAD daily chart with support and resistance lines on it. Click to enlarge:

- Ivey PMI: Monday, 14:00. Ivey PMI slipped to 50.9 points last month, remaining in growth mode. However, this was well short of the estimate of 55.7 points. The markets are expecting a rebound in the upcoming release, with an estimate of 53.4 points.

- Building Permits: Tuesday, 12:30. Building Permits has been a pleasant surprise, posting strong gains for three consecutive months. The indicator has easily beaten expectations in each of these readings. In August, the indicator jumped 11.8%, crushing the forecast of -4.2%.

- Housing Starts: Wednesday, 12:15. The indicator dipped to 192 thousand last month, shy of the estimate of 197 thousand. This marked a 5-month low for the indicator.

- NHPI: Thursday, 12:30. The New Housing Price Index is a useful gauge of activity in the housing industry. The index remains at weak levels and came in at a flat 0.0% last month. The markets are expecting a small gain of 0.2% in the upcoming release.

- Employment Change: Friday, 12:30. Employment Change is one of the most important economic indicators and traders should treat it as a market-mover. The indicator dropped sharply last month, posting a decline of -11.0 thousand. This was nowhere near the estimate of 10.3 thousand. Will the indicator bounce back this month? The unemployment rate has been steady, posting two straight readings of 7.0%.

- BOC Business Outlook Survey: Friday, 14:30. This quarterly report is based on a survey of about 100 businesses, which are asked to rate business conditions as well as their plans for spending and hiring. It provides a useful gauge of the strength of the business sector.

* All times are GMT.

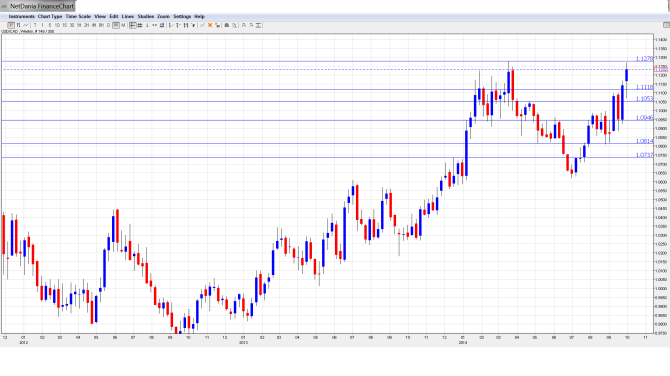

USD/CAD Technical Analysis

USD/CAD opened the week at 1.1116. The pair touched a low of 1.1071 and then reversed directions, climbing all the way to 1.1270, as resistance held at 1.1278 (discussed last week). The pair closed the week at 1.1232.

Live chart of USD/CAD: [do action=”tradingviews” pair=”USDCAD” interval=”60″/]

Technical lines, from top to bottom:

1.1640 provided has provided resistance since June 2009. This marked the start of a US dollar rally which saw the pair drop close to the 0.94 line.

1.1494 was a key resistance line in November 2006.

1.1369 was breached in October 2008 as the US dollar posted sharp gains, climbing as high as the 1.21 level. This line has remained steady since July 2009.

1.1278 held firm as the pair moved higher late in the week. This line marked the start of a rally by the Canadian dollar, which dropped below the 1.09 level.

1.1122 was breached for a second straight week and has switched to a support role. It has some breathing room as the pair trades above the 1.12 level.

1.1054 is a strong support line. 1.0944 is next.

1.0815 has held firm since late August.

1.0737 marked a cap in mid-2010, before the US dollar tumbled and dropped all the way into 0.93 territory. It is the final support line for now.

I remain bullish on USD/CAD

US numbers continue to look strong, as underscored by last week’s excellent NFP and the unemployment rate. The Canadian economy has not been able to keep pace and the US dollar stands to benefit and post more gains.

In our latest podcast, we discuss the big events for October:

Subscribe to our podcast on iTunes.

Further reading:

- For a broad view of all the week’s major events worldwide, read the USD outlook.

- For EUR/USD, check out the Euro to Dollar forecast.

- For the Japanese yen, read the USD/JPY forecast.

- For GBP/USD (cable), look into the British Pound forecast.

- For the Australian dollar (Aussie), check out the AUD to USD forecast.

- USD/CAD (loonie), check out the Canadian dollar.