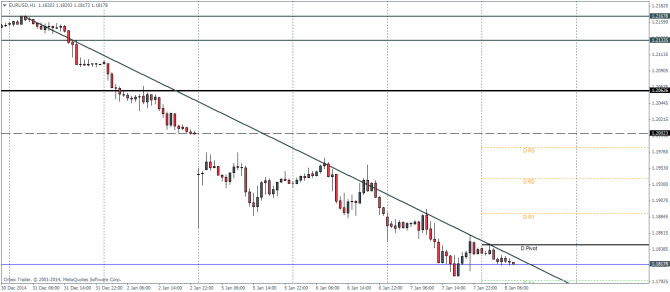

EURUSD Daily Pivots

| R3 | 1.1983 |

| R2 | 1.1939 |

| R1 | 1.1888 |

| Pivot | 1.1845 |

| S1 | 1.1794 |

| S2 | 1.175 |

| S3 | 1.17 |

A break of the lows at 1.183 is likely to pave way for more declines in the Euro against the Dollar. But considering price is trading close to the respected trend line, a break out to the upside could pose a risk of a rally targeting 1.19 – 1.88 followed by the unfilled gap at 1.2.

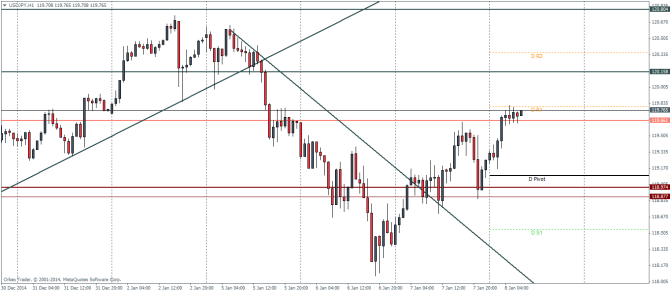

USDJPY Daily Pivots

| R3 | 121.063 |

| R2 | 120.335 |

| R1 | 119.804 |

| Pivot | 119.096 |

| S1 | 118.545 |

| S2 | 117.837 |

| S3 | 117.286 |

The Dollar-Yen is currently aiming to push higher but is struggling near previous resistance/support level of 119.66 regions. If this level caps the gains, we can expect to see USDJPY decline to the daily pivot level of 119.09 a break of which could see a decline lower to 118.2.

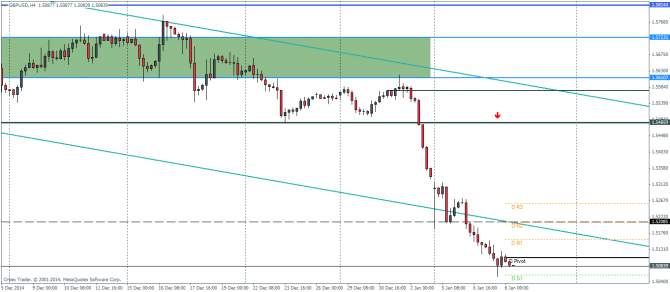

GBPUSD Daily Pivots

| R3 | 1.5258 |

| R2 | 1.5206 |

| R1 | 1.5157 |

| Pivot | 1.5107 |

| S1 | 1.5059 |

| S2 | 1.5007 |

| S3 | 1.4958 |

The Cable continues to gradually push lower with the next major support coming in at 1.4922. However a bounce to the upside could see the Cable rally towards the minor support level broken at 1.52085 before settling lower. Alternatively, a break above 1.52085 could see a rally to test the next broken support level at 1.5486 level for resistance.