The third Hungarian Republic emerged three years prior to the collapse of the Soviet Union. Political opposition leaders came to agreement on both political and economic reforms and opened its borders, most notably with neighboring Austria. Hungary is landlocked, bordered by Austria and Slovenia on the west, Croatia, Bosnia-Herzegovina and Serbia towards the south, Romania and Ukraine towards the east and Slovakia on the north.

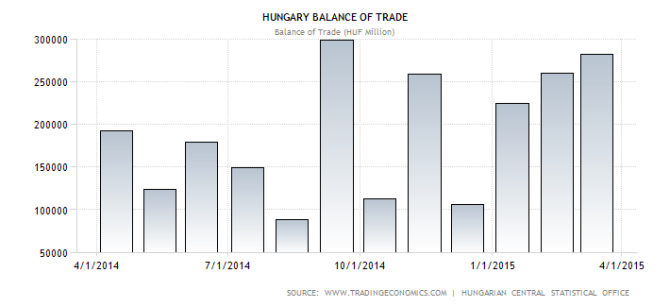

Hungary is an EU member state, a member of Organization for Economic Co-operation (OECD) and World Trade Organization (WTO) . It ranks 43rd out of 175 nations with Gini index 31.2. According to the World FactBook, Hungary’s 2014 PPP-GDP was £152.8 billion with 2.8% real growth rate. Per capita PPP-GDP is £15,477 and gross national savings approximately 21% of GDP. Household consumption is approximately 54.5% of GDP, government consumption 19.5% of GDP, investment 22% of GDP and the positive trade balance about 3.3% of GDP. About 12% of the population is below the poverty line.

Guest post by Mike Scrive of Accendo Markets

Hungary’s trade partners reflect its EU member status and its geographical location. Germany accounts for 25.6%; Romania, 6.2%; Slovakia, 6.1%; Austria 6.0% and Italy, France and the U.K. account for 14%, (in total). Major exports are transportation equipment, machinery, agricultural produce, apparel, textiles, iron, steel and wine from its respectable ‘vinery domaine’. Import partners extend further from the EU although Germany is still at the top with over 25%. Imports from Russia account for 8.8%; China 7.4%; Austria, 7.1% and Slovakia, Poland, Italy and the Netherlands 19% (in total). Intermediate imports goods include machinery, fuels, electricity, food and raw materials.

Hungary is a net importer of electricity. The bulk of its electricity, 70%, is produced by fossil fuels. Else nearly 20% is generated from nuclear and nearly 9% from renewables. Hungary has proven oil and gas reserves of 27.3 million bbl and 28 billion ft3, respectively. Coal consumption exceeds production by 1.74 million tons.

Matolcsy György is the governor of Magyar Nemzeti Bank, (MNB) . The MNB is an independent central bank whose primary objective, “is to achieve and maintain price stability”, however, also states that, “Without prejudice to its primary objective, the Magyar Nemzeti Bank supports the economic policy of the Government, using the monetary policy instruments at its disposal”. The main policy tool is the two week MNB deposit, currently at 1.80%. Hungary uses its own currency. Its basic unit is the Forint, and its 10 year bond most recently quoted at 2.86%, and government debt is S&P rated BB+ with a negative outlook.

Hungary’s public debt is almost 79% of GDP. The unemployment rate is over 7% and most recent inflation measure approximately, -1.0% up from the previous measure of -1.4%. Hungary has had negative inflation since January of 2014 with the exception of July and August of that year. The most recent EUR/HUF was 310.72 per Euro.

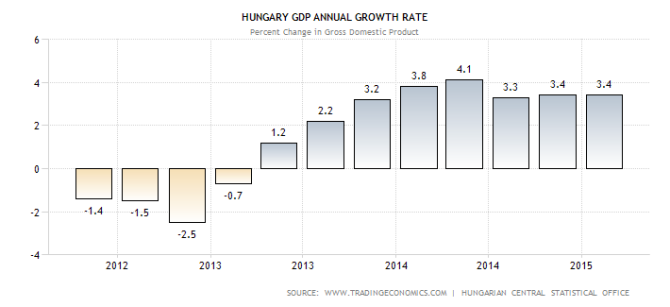

Since the time of the 2008 credit collapse, the economy had struggled with a deeply entrenched ‘bubble legacy problem’. Before the collapse, lower interest rates abroad attracted Hungarians property buyers to foreign currency denominated mortgages, particularly in Swiss Francs or Euros. The idea worked well until 2008 collapse, the after effects of which weakened the Forint. This caused mortgage payments to ‘balloon’ relative to Swiss Francs or Euros . After many attempted fixes, the Hungarian government passed comprehensive legislation allowing Hungarian foreign currency mortgage holders to convert to Forints. The permanent fix plus stimulus eventually moved the economy into recovery.

USD/HUF marked its 52 week low in June of 2014 and move upward along with a strengthening US Dollar, testing trend line resistance until September, 2014. From 9 September through mid-December, USD/HUF traded well below trend. Although expectations for the impending next phase of the ECB’s QE program and the US Fed’s willingness to be patient on rate increases may have contributed towards Forint weakness, Swiss bank actions on 15 January, no doubt, had the greatest affect. The next big spike coincided with much stronger than expected industrial output growth along with 3.5% Q4 GDP growth, also well above expectations.

During the intervening period from the 52 week low of $220.905 in May of 2014 through to the high of 292.25, the combination of mortgage reform legislation, $4.0 billion in mortgage refund settlements, lower fuel costs, lower public debt as a percentage of GDP, a benchmark rate cut and a $3 billion government funded low interest loan plan are expected to increase GDP growth to 3.5%. S&P has upgraded Hungary’s debt and analysts expect a further rate cut as well. The successful, well managed economic recovery has not helped the popularity of the present government however; hence a potential for politically generated market volatility. Aside from politics, the Hungarian Forint seems to have stabilized against the dollar. Should USD/HUF break Fibonacci support at $268.094 support level, it is likely to continue trending lower, to at least the next support level.

Mike Scrive

“CFDs, spread betting and FX can result in losses exceeding your initial deposit. They are not suitable for everyone, so please ensure you understand the risks. Seek independent financial advice if necessary. Nothing in this article should be considered a personal recommendation. It does not account for your personal circumstances or appetite for risk.”