The NEw Zealand dollar experienced more pressure in a week that saw a surge of the US dollar and another fall in the price of milk.

What’s next for the pair? The team at ANZ stays short:

Here is their view, courtesy of eFXnews:

“ANZ is calling for an “insurance” cut to the OCR in both June and July, which would step NZD lower. While we have moved our FOMC call from June to September, we still expect the USD to find solid demand on the inevitable pull-backs. Thus importers should consider using any NZD strength to extend hedges, both in duration and size. For exporters we believe in keeping duration short, but see value in short-duration hedges on weakness,” ANZ adds.

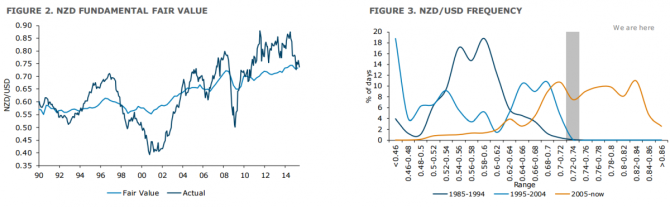

“The NZD/USD is trading in line with both ANZ fundamental fair value and cyclical fair value. Technically NZD/USD remains within a falling trend, with strong resistance at 0.77 and support at 0.72 on the wide. We do not expect NZD to regain the 0.76 handle this coming month and see risks lower,” ANZ projects.

In line with view, ANZ maintains a short NZD/USD position from 7405, with a stop 0.7610, and a target at 0.7010.

For lots more FX trades from major banks, sign up to eFXplus

By signing up to eFXplus via the link above, you are directly supporting Forex Crunch.