Two major pairs feature very interesting technical patterns: Cable sees an inverted head and shoulders pattern while EUR/USD is experiencing a double top (according to our analysis) and a double bottom according to RBS.

Here we go:

Here is their view, courtesy of eFXnews:

GBP/USD technical set-up has turned bullish amid an inverted Head and Shoulders pattern and a bounce from a key support area from last week, notes RBS.

“The pair has not moved much over the past week, but indicated we are likely to be on the right side, as a weekly chart saw an inverted advance block pattern finished by a Doji candle at a time of MACD staying positive,” RBS argues.

“The above-mentioned signals confirm the next move is likely to be to the upside, targeting 1.6070 onto 1.6430 stopping on a close below 1.5100,” RBS projects.

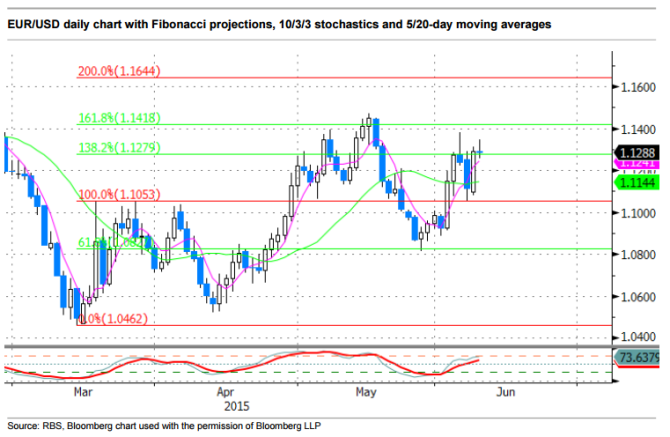

Turning to EUR/USD, RBS maintain the same bullish stance, noticing that the pair formed a local base after bouncing from the 1.08 support level, being the 38.2% Fibonacci retracement from the March impulse wave, and forming a double bottom pattern.

“Yesterday’s price action confirmed my view by the Marubozu candlestick pattern. This pattern has a pivot point at 1.1194 (the midpoint of the candle’s body) providing a key support level,” RBS notes.

“Hence we keep the same view for a move to the 2 nd target of 1.1644 with further test of 1.20-ish area possible,” RBS projects.

For lots more FX trades from major banks, sign up to eFXplus

By signing up to eFXplus via the link above, you are directly supporting Forex Crunch.