EUR/USD already began the week with a storm on the Greek crisis. But much more action is probably ahead on the road.

The team at Barclays focuses on the FOMC and explains why going short is a good option:

Here is their view, courtesy of eFXnews:

In its weekly FX note to clients today, Barclays Capital advises clients to stay short EUR/USD going into this week’s FOMC meeting.

The following is Barclays’ rationale behind this argument along with the details of its current short EUR/USD position.

USD into FOMC:

“Markets will pay close attention to the tone of the FOMC statement on Wednesday and watch for hints on the timing of the first rate hike. Given the recent pickup in US consumption and labor market data, we think the Fed is likely to maintain its view that the winter slowdown was transitory and that the economy is likely to expand at a moderate pace. Indeed, the pace of job growth has picked up, with payrolls rising 280K in May, and the Fed’s LMCI has increased since the April meeting. Additionally, we expect the Fed to reiterate that inflation will gradually rise toward the 2% target in the medium term as the labor market continues to improve and inflation expectations remain stable,” Barclays clarifires.

“Indeed, CPI data on Thursday, along with the latest import price data, should support our view that downward pressures on domestic core inflation from the lagged effects of USD appreciation will begin to wane going into the third quarter. As such, we continue to think the Fed is on track to hike twice this year (at the September and December meetings),” Barclays projects.

“Overall, we believe that the FOMC statements, along with CPI and other macro data, should support the USD,” Barclays argues.

EUR amid Greek Uncertainty:

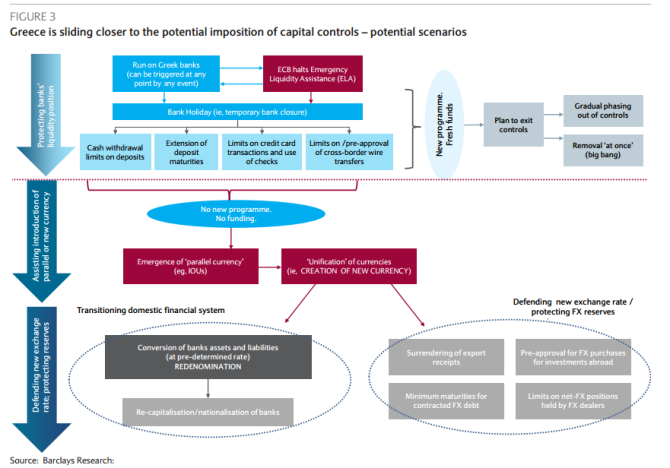

“Greek political uncertainty remains high, as the gap in negotiations between Greece and the Institutions remains substantial. The IMF is reported to have walked away from talks with Greek officials on Thursday because of the inability to find agreement on such issues as pension and tax reforms. Meanwhile, the economic and financial situation is continuing to deteriorate in Greece, with the state revenue shortfall having grown €1bn in May to reach a total of €2bn, and with the ECB having last week raised the limit on the Emergency Liquidity Assistance (ELA) to Greek banks by a further €2.3bn, to €83bn. The Eurogroup and ECOFIN meetings will be held on 18 and 19 June, respectively,” Barclays notes.

“We think a failure to find agreement will make it difficult to have a smooth resolution before the end of June, when the programme expires. Another extension of the programme is possible, although not straightforward as it would require the approval of some national parliaments, including the Bundestag in Germany,” Barclays argues.

Staying short EUR/USD:

“We believe the market is underpricing the risks of increased volatility. We continue to recommend staying short EURUSD spot,” Barclays advises.

The Trade:

Barclays maintains a short EUR/USD position from 1.1240, with a stop at 1.1680, targeting a move to 1.0460.

For lots more FX trades from major banks, sign up to eFXplus

By signing up to eFXplus via the link above, you are directly supporting Forex Crunch.