If we put Greece and other fundamental indicators aside, we can find interesting technical patterns.

The team at RBS provides two risk reward trades on EUR/USD and GBP/USD:

Here is their view, courtesy of eFXnews:

In both of GBP/USD and EUR/USD, the current levels provide excellent risk- reward ratio for engaging in long technical-driven trades, notes RBS Techs.

Starting with GBP/USD, RBS thinks that the 1.55/1.56 area should provide a good support.

“We see no signals to alter the view and believe Cable has more to go towards the targets of 1.6070 and 1.6433 amid an inverted Head and Shoulders pattern and positive MACD,” RBS projects.

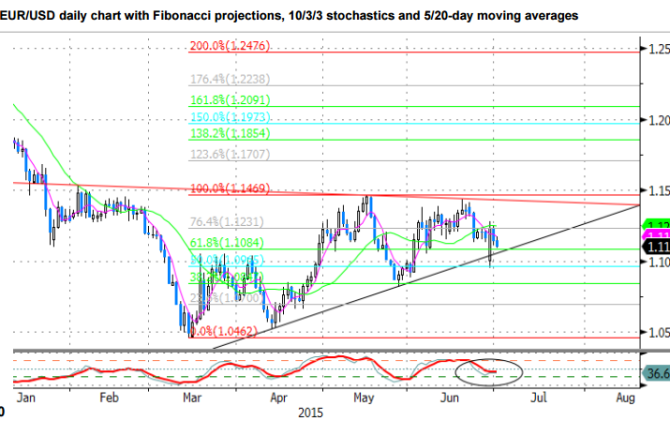

Turning to EUR/USD, RBS sees an excellent risk/reward ratio for buying, as the risk level of 1.10 is very close, but potential target goes as far as 1.24, RBS advises.

“This is the ultimate target of a potential inverted Head and Shoulders pattern, which would be triggered on a break above 1.1450,” RBS argues.

“If so, the targets will include 1.1850, 1.2090 and 1.2470. Stop is a close below 1.0965,” RBS adds.

For lots more FX trades from major banks, sign up to eFXplus

By signing up to eFXplus via the link above, you are directly supporting Forex Crunch.