The Canadian dollar is down but certainly not out given the recent moves in oil prices. What’s next for the loonie?

The team at Credit Agricole advises against selling the C$ around current levels, and explains:

Here is their view, courtesy of eFXnews:

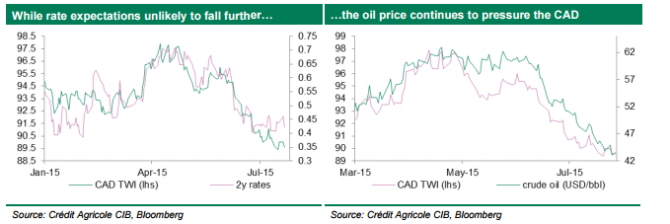

Although renewed USD strength on the back of rising Fed rate expectations are likely to keep commodity price developments muted, we see only limited CAD downside risk from the current levels.

This is mainly due to the view that monetary policy prospects should become more important in the weeks to come, as a further improving US growth outlook should come to the benefit of Canada too.

From that angle this week’s main focus will be on both June retail sales and July inflation data. Only material weaker than expected data is likely to increase investors’ BoC easing expectations further.

Considering room of further stabilising rate expectations and, as speculative short positioning remains close to elevated territory, we advise against selling the CAD around the current levels, at least against currencies such as the EUR.

For lots more FX trades from major banks, sign up to eFXplus

By signing up to eFXplus via the link above, you are directly supporting Forex Crunch.