Talking Points

- US dollar struggled recently against the Japanese Yen, and looks set for a break in the near term.

- Japanese Merchandise Trade Balance Total released by the Ministry of Finance posted a trade deficit of ¥-268.1B in July 2015.

- Japanese All Industry Activity Index released by the Ministry of Economy, Trade and Industry registered an increase of +0.3% in June 2015, which was lower compared with the forecast of a +0.4% rise.

- USDJPY has formed an interesting structure and looks poised for a break moving ahead.

Key Highlights:

Japanese Merchandise Trade Balance

Japanese All Industry Activity Index

USDJPY Technical Analysis

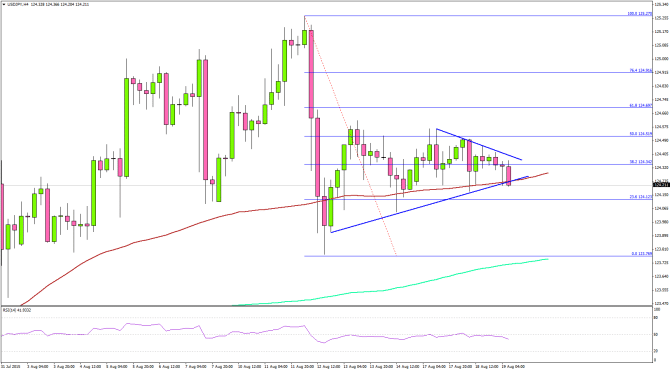

The USDJPY pair has formed a triangle pattern on the hourly chart, which looks set for a break in the short term. The triangle support area is aligned with the 100 hourly simple moving average, which is a positive sign. However, the pair is under bearish pressure and might break down to ignite more losses.

If there is an hourly close below the triangle support and 100 SMA, then a move towards the last swing low of ¥123.76 is possible.

On the upside, a break above the triangle resistance area might release the bearish pressure for some time.

Fundamentals

Earlier today during the Asian session there were a few key releases scheduled in Japan, including the Merchandise Trade Balance report and the All Industry Activity Index. The Merchandise Trade Balance Total, which is a measure of balance amount between import and export was released by the Ministry of Finance. The forecast lined up for a trade deficit of ¥-56.7B in July 2015. However, the result was disappointing, as the Merchandise Trade Balance posted a deficit of ¥-268.1B.

Moreover, the Japanese All Industry Activity Index that captures the monthly change in overall production by all industries of the Japanese economy was released by the Ministry of Economy, Trade and Industry. The outcome was again lower, as the index rose +0.3% in June, lower compared with the forecast of +0.4%.

There was no major reaction in the Japanese yen after the release, as the USDJPY pair traded in a range.

“”””””””””””””””””””””””””””””””””””””””””””-

Article by Tom Daly, Academy of Financial Trading

“”””””””””””””””””””””””””””””””””””””””””””-