The countdown to the Fed decision continues and as we noted, there are preferred currency pairs to trade in each scenario.

Here is another view from BNP Paribas, that puts it all into one diagram:

Here is their view, courtesy of eFXnews:

BNP Paribas expects a neutral-to-dovish outcome from Thursday’s FOMC meeting with the Committee likely to leave policy unchanged and steer markets away from pricing an October lift-off.

“December will still remain very much on the table, with the dots still likely to suggest one hike by the year end. However, markets will remain reluctant to price this, amid scepticism that the data and market conditions will be any more conducive to tightening in December than they were this week,” BNPP argues.

So how to trade the USD going into FOMC?

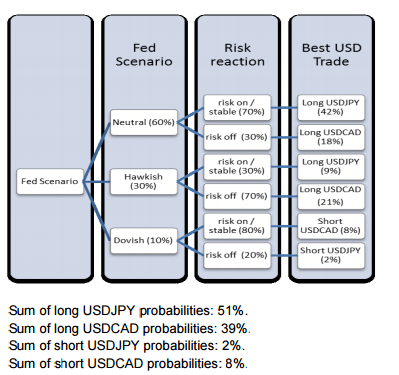

BNPP puts together the diagram below which provides a stylized probability distribution for possible outcomes to the Fed meeting. For simplicity’s sake, BNPP sticks to USDJPY as a representative long USD versus funder trade, and long USDCAD as a long USD versus commodity exporter trade.

BNPP defines three Fed scenarios:

1- Fed neutral (our base case): no change in policy, no setup for October hike, but December stays on the table via dots and message.

2- Fed hawkish: rate hike or definitive signal of October rate hike.

3- Fed dovish: no change in policy and December taken off the table.

BNPP also adds two risk reaction scenarios:

1- Risk on or stable: S&P 500 down less than 0.5% or higher from pre-FOMC levels by end of day Friday (18 September).

2- Risk off: S&P 500 down 0.5% or more by end of day Friday.

“Our analysis suggests that long USDJPY is a superior trade heading into the FOMC, but that risk reward is also attractive for USDCAD. We remain long both pairs, consistent with our base case scenario and medium-term view on the USD,” BNPP advises.

For lots more FX trades from major banks, sign up to eFXplus

By signing up to eFXplus via the link above, you are directly supporting Forex Crunch.