Trading cable can be quite choppy. Perhaps it’s important to watch out for EUR/GBP as a signal to the next moves.

Here are the views from UBS on future moves of the pound against the dollar.

Here is their view, courtesy of eFXnews:

BoE Governor Carney’s inconsistencies on the currency appear to have cost sterling of late, notes UBS.

“In the wake of the August inflation report it seems clear that the threat of persistent headwinds from sterling strength will feature for some time to come. Kristin Forbes is clearly leading the effort to quantify pass-through but the process seems quite dynamic,” UBS adds.

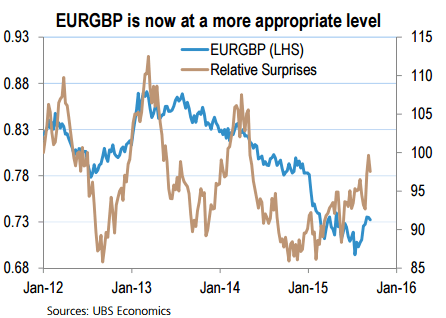

“We believe the sterling trade is very straight forward: GBPUSD can rise through 1.60 as long as EURGBP is anchored at 0.70 or above,” UBS argues.

“Given EURGBP is the bulk of the ERI, and the assumptions for the index are at 93, there is minimal scope for GBP to rise against both simultaneously before the BoE relents. We target a February hike,” UBS projects.

For lots more FX trades from major banks, sign up to eFXplus

By signing up to eFXplus via the link above, you are directly supporting Forex Crunch.