EUR/USD dropped a lot on recent monetary policy divergence expectations, but still hesitates.

What’s holding it back? The team at Credit Suisse provides answers:

Here is their view, courtesy of eFXnews:

In its weekly note to clients today, Credit Suisse discusses its outlook for EUR/USD heading into the Fed and ECB December meetings. CS outlines its projections for these two meetings along with its EUR/USD targets. CS also highlights 3 main possibilities that could stand in the way of a relentless fall in EUR/USD?

Fed, ECB December Meetings:

“Last week’s strong US payrolls data played well into our underlying bullish dollar view. Policy divergence has been a key driver for us, and our US economists believe US macro data are sufficiently robust to allow the Fed to hike by 25bp in Decembe. Our European economists meanwhile see the ECB cutting rates in December,” CS projects.

Not The End Of USD Rally:

“We are skeptical of views suggesting that a Fed rate hike will signal the end of the USD rally. If anything, we suspect this degree of overt policy divergence raises the risk of a form of USD “melt up” into 2016 that as a material risk case could even take EURUSD as far as parity within 2015.

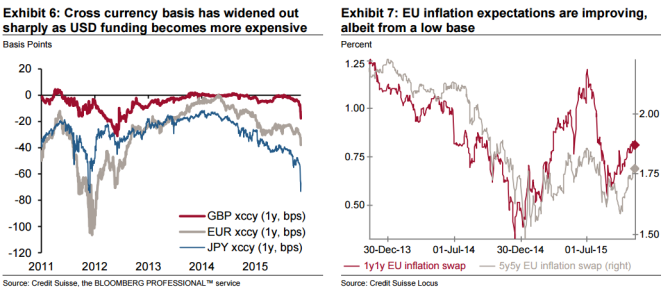

We note also that cross-currency basis markets are relentlessly pushing higher the cost of USD funding. Not only does this make long USD positions more attractive from a carry perspective but it also indicates potential shortages of USD funding, which may be an important issue ahead of year-end, especially with the Fed set to hike rates. Such developments further encourage our USD-bullish view,” CS adds.

So what stands in the way of a relentless fall in EUR/USD? CS sees three main possibilities:

1. USD strength spooks the Fed: “As the March FOMC showed, the Fed has this year already proved sensitive to outsized USD gains. With the broad trade-weighted USD up nearly 3% in the past month, we can imagine the Fed having to contend with a similar size move in the next few weeks ahead of the 16 December FOMC meeting. It remains possible that the Fed chooses to stay on hold under such circumstances, especially if the ECB cuts rates as expected on 3 December,” CS argues.

2. New EURUSD lows ahead of 3 December: “If EURUSD is making new 2015 lows by its December meeting, the ECB could yet decide to hold off easing as much as markets now expect given the monetary-conditions loosening that a weaker EUR implies. We note that euro area inflation expectations have been moving steadily higher towards acceptable levels. Still, our base case remains that ECB President Draghi will feel compelled to follow through on what the market sees as promises and ease policy in order to avoid a violent reversal of these positive developments,” CS adds.

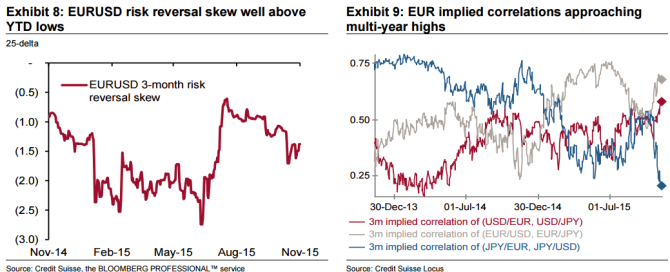

3. A risk-off event: “Elements of market pricing such as implied correlations are pointing to the market pricing in higher odds of a unilateral EUR move relative to other currencies. Associated with this is the possibility of the EUR having taken on the role of a funding currency. Typically, funding currencies rally strongly when asset markets are shaky, as evidenced by EUR’s generalized strength between August and October. A similar development – especially if catalyzed directly by currency concerns such as USD strength hurting US equity earnings – would allow for at least a temporary EUR recovery,” CS clarifies.

EUR/USD Forecats:

CS now sees EUR/USD trading at 1.04 in 3-month and at 1.00 in 12-month.

For lots more FX trades from major banks, sign up to eFXplus

By signing up to eFXplus via the link above, you are directly supporting Forex Crunch.