EUR/USD is holding on to high ground reached after the Draghi disappointment.

The team at SocGen explores the next moves:

Here is their view, courtesy of eFXnews:

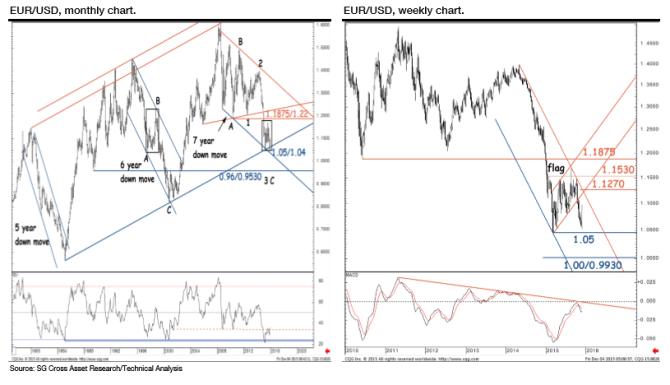

After breaching below the flag formation, EUR/USD has retested March lows of 1.05/1.04 which more importantly correspond with the multi decadal channel lower limit, notes SocGen.

“Currently a sharp rebound is being witnessed however signs of reversal still lack. Monthly RSI indicator is probing a horizontal line while weekly MACD still languishes within negative territory and below a resistance line,” SocGen adds.

“Thus indicators point towards limited upside in EUR/USD and the rebound is likely to remain capped,” SocGen argues.

“Ongoing correction is retracing the 2000-2008 up move however a break below key levels of 1.05/1.04 will confirm that this is in fact a downtrend of a larger degree.

In such a scenario we can expect retracement of the whole up cycle since the 1980s and first meaningful support will be at 1.00/0.9930 and next at graphical levels of 0.96/0.9530 consisting of 1989 lows, 2001 highs and a projection for the down move,” SocGen projects.

For lots more FX trades from major banks, sign up to eFXplus

By signing up to eFXplus via the link above, you are directly supporting Forex Crunch.