The Australian dollar had its time in the sun following the “not-too terrible” Chinese GDP data, which the markets cheered. However, this honeymoon may be over, with AUD/USD falling back to critical support and looking even lower.

The factors moving the A$ come from China, Australia but also from abroad:

- Australian consumer sentiment falls: The Westpac Consumer Sentiment dropped by 3.5%, after a fall of 0.8% beforehand. If Australia needs domestic demand to substitute China, this isn’t coming thick and fast.

- Chinese FDI slows: The data continues pouring out of the economic giant and it shows further slowdown: Foreign Direct Investment is rising at a rate of 6.4% against 7.9% seen previously. Less investment – less demand for Australian commodities.

- Carney carnage: Australia’s is still officially under the rule of The Queen, and from the UK we had a very gloomy outlook by Mark Carney, the governor of the BOE. This sent reverberations worldwide.

- Falling commodity prices: Prices of Australia’s metal exports as well as the price of crude oil are on the downside once again. The explanation that the recent crude crash was a problem of supply due to Iran and not demand seems to have faded away.

- New Zealand inflation: Australia’s neighbor has reported a bigger than expected drop in inflation, 0.5%, a figure which opens the door to more rate cuts over there. Australia could certainly be next with downwards inflation pressures.

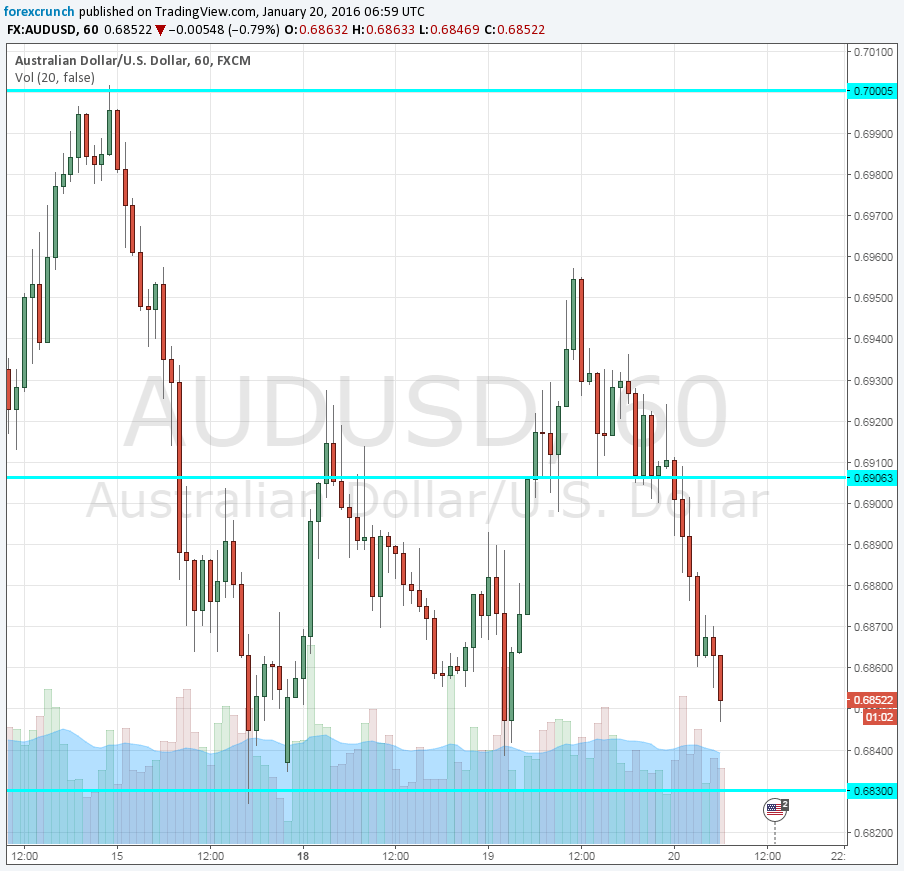

Here is how this look in the chart. The pair is currently trading around 0.6850, just above the lows of 0.6830, and it’s getting closer. Below this line, it’s back to levels last seen in 2009. Will we see a breakdown?

More: 4 Reasons To Sell AUD/USD, NZD/USD – Deutsche Bank