Wages rose by 2%, against 2.1% expected, but excluding bonuses they rose 1.9% instead of 1.8% predicted. This is balanced. Good news came from the unemployment rate that surprised with a drop to 5.1%. Jobless claims for November surprised with a drop of 4.3K and last month’s figure was revised to a drop of 2.2K instead of a rise initially reported.

So, wages are cooling as expected but the number of jobless is dropping very nicely, and that’s good news. All in all, better than expected.

Can the pound recover? Once again, data was not too shabby, but this bounce could still turn into a dead cat bounce.

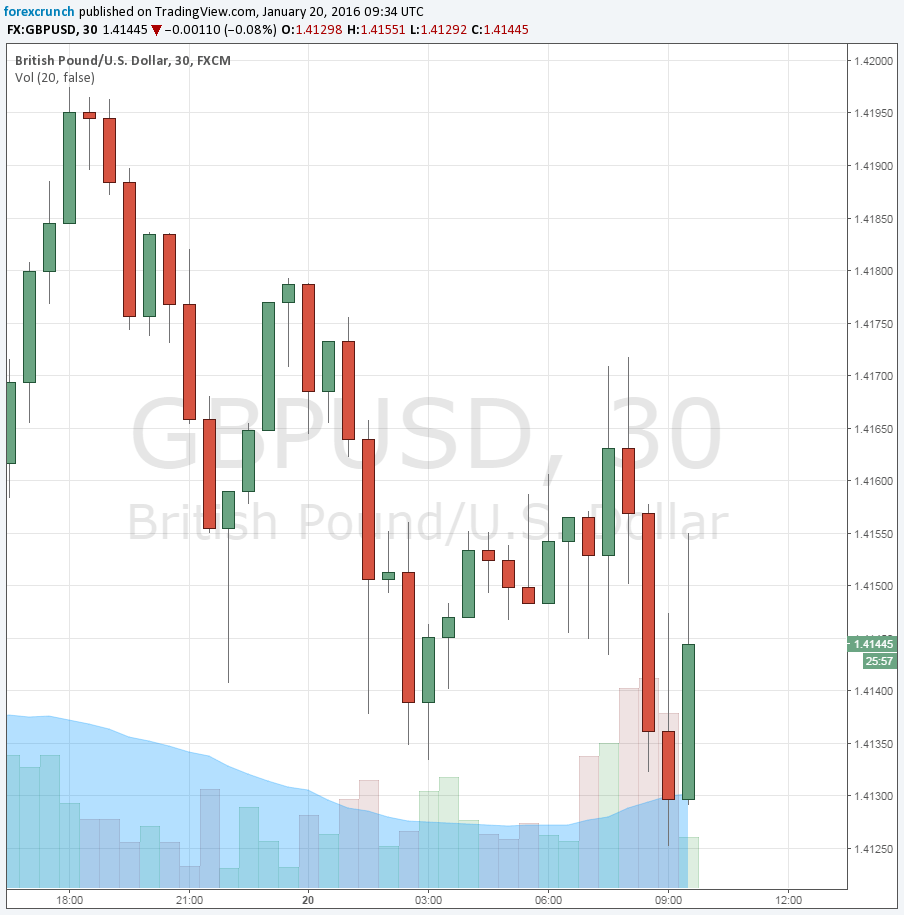

The initial reaction is a rise from the lows of 1.4125 to 1.4150, but the pound is certainly hesitating, waiting for the next hammer to fall.

The UK was expected to report a rise of 2.1% in average hourly earnings in November, down from 2.4% in October. Excluding bonuses, a slide from 2% to 1.8% was on the cards. The unemployment rate was predicted to remain unchanged at 5.2%. The Claimant Count Change (jobless claims) were predicted to rise by 2.5K in December after +3.9K in November, before revisions.

The British pound was suffering, with GBP/USD traded around 1.4140 before the release. Despite better than expected inflation figures, Carney statement that “now is not the time raise rates” continues echoing and pounding the pound, with mercy nowhere to be seen.

The preview: Trading the UK wages with GBP/USD.