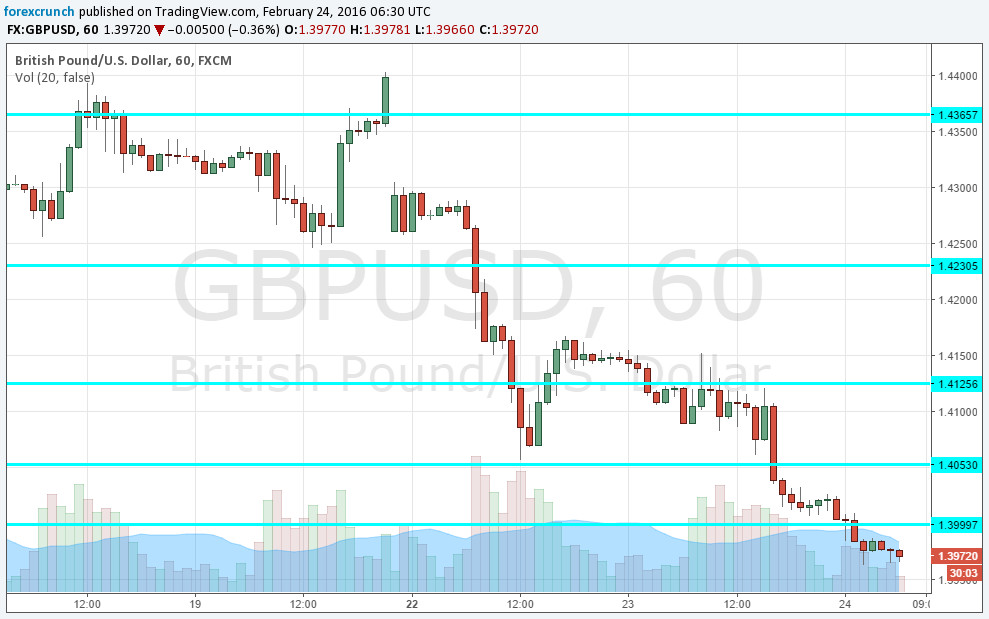

The Boris blow continues taking its toll: to the chances of a Brexit breaking the pound we also got a negative market mood which favors other currencies, and the result is the loss of the very round level.

GBP/USD is currently at the lowest levels in nearly 7 years. The low so far has been 1.3964 and the pair is stabilizing around 1.3980.

Brexit Fears

Fresh opinion polls released in the UK show the following results:

- YouGov online poll shows REMAIN 37% vs. LEAVE 38%

- ComRes telephone poll shows REMAIN 51% vs. LEAVE 39%

Another comment on this:

ComRes was asked Friday to Monday (so started before Cameron’s deal was finalised), YouGov’s poll was asked between Sunday and Tuesday, so was after Cameron’s renegotiation, but straddled Boris Johnson’s endorsement of the Leave campaign.

Oil prices

One of the factors weighing on the mood is the fresh fall in oil prices, triggered by the Saudis refusal to cut production. In addition, API showed yet another buildup in oil inventories. WTI crude oil, which was already trading above $33 yesterday is down to the $31 handle.

Saudi oil minister Al-Naimi rejected oil cuts, eroding all the previous talk about a production freeze.

More: GBP/USD targeting 1.39 – Why is Sterling weak?

This is how it looks on the chart: