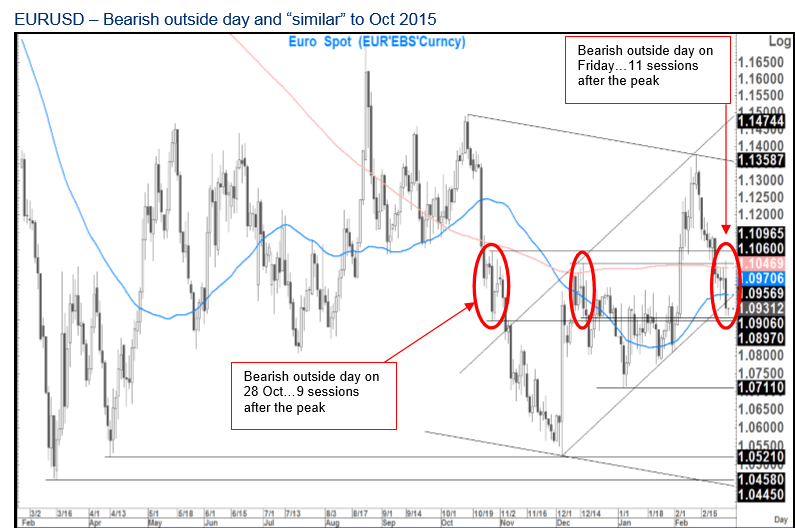

Will the euro jump after the ECB decision like in December 2015 or crash like in January 2015? The team at Citi sees similar patterns to October 2015:

Here is their view, courtesy of eFXnews:

The price action on EURUSD is similar to that seen in October as the market re-assessed where it stood with the Fed and prepared for the Dec ECB meeting, notes CitiFX.

“EURUSD has sustained the break below levels in the 1.1050-60 area which was the previous breakout level on the way up at the beginning of Feb and also where the 200 day moving average comes in. We also closed the week below the 55 week moving average last week which is another bearish development – it cannot be seen on the daily chart above.

Furthermore, we have closed below the base of the rising channel and posted a bearish outside day as a continuation pattern to move lower. The bearish outside day is similar to that seen on 15 Dec 2015 from the same levels (middle red circle). From there we continued lower until 5 Jan 2016,” Citi adds.

For latest trades & forecasts from major banks, sign-up to eFXplus

This broad price action, according to Citi, is also similar to Oct 2015.

“Then we peaked on 15 Oct 2015. 9 sessions later (28 Oct) we posted a bearish outside day below the 200 day moving average. We closed that session at 1.0924 (left circle). – This was followed by a brief consolidation for 2 sessions and then another turn down all the way into the 3 Dec ECB meeting.

This time – We peaked on 11 Feb. 11 sessions later we posted a bearish outside day below the 200 day moving average. That was Friday when we closed at 1.0933 (right circle) – Even if we see a brief consolidation/bounce over a session or two like we saw on 29 and 30 Oct 2015, it is unlikely to upset the downtrend. Support levels are at 1.0711, 1.0520 and then 1.0458,” Citi clarifies

Overall Citi projects a move back towards the trend lows of 1.0458, with interim supports at 1.0711 and 1.0520, is likely to be seen.

For lots more FX trades from major banks, sign up to eFXplus

By signing up to eFXplus via the link above, you are directly supporting Forex Crunch.