All the UK figures missed expectations and they were also accompanied by downwards revisions across the board. Manufacturing fell 1.1% m/m and 1.8% y/y. Industrial output dropped 0.3% m/m and 0.5% y/y. The trade balance stands at -11.964 billion but at least it’s not worse than the significantly downwards revised figure for the previous month, to 12.157 billion. This doesn’t look good, no matter how you look at it.

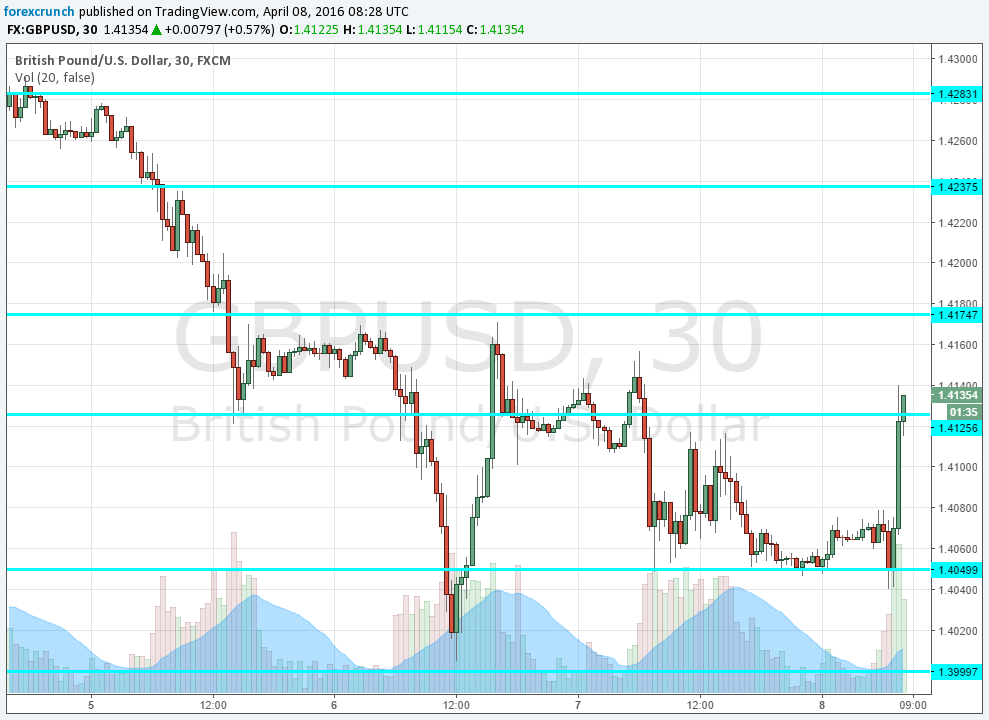

GBP/USD is reversing its gains, dropping to just above 1.41.

The UK trade balance was expected to remain more or less unchanged at -10.2 billion, a significant deficit. Manufacturing production was expected to drop 0.2% after a rise of 0.7%. Year over year, a slide of 0.7% expected after 0.1%. The industrial output number was predicted to rise 0.1% after +0.3% and y/y, a flat read was predicted to rise 0.2%.

GBP/USD was front running the publication with a nice rise from support at 1.4050 all the way to 1.4132.

The pound still suffers from political trouble more than any indicator. The Panama Papers implicate UK PM David Cameron in offshore holdings. This complicates the already problematic campaign to prevent a British exit from the European Union.

This is the cable 30 minute chart: