US housing starts rise 4.8% to 1.189 million annualized, but on top of a downwards revision. Building permits are up 1.5% reaching 1.153 million annualized. The bottom line is a slight beat of expectations.

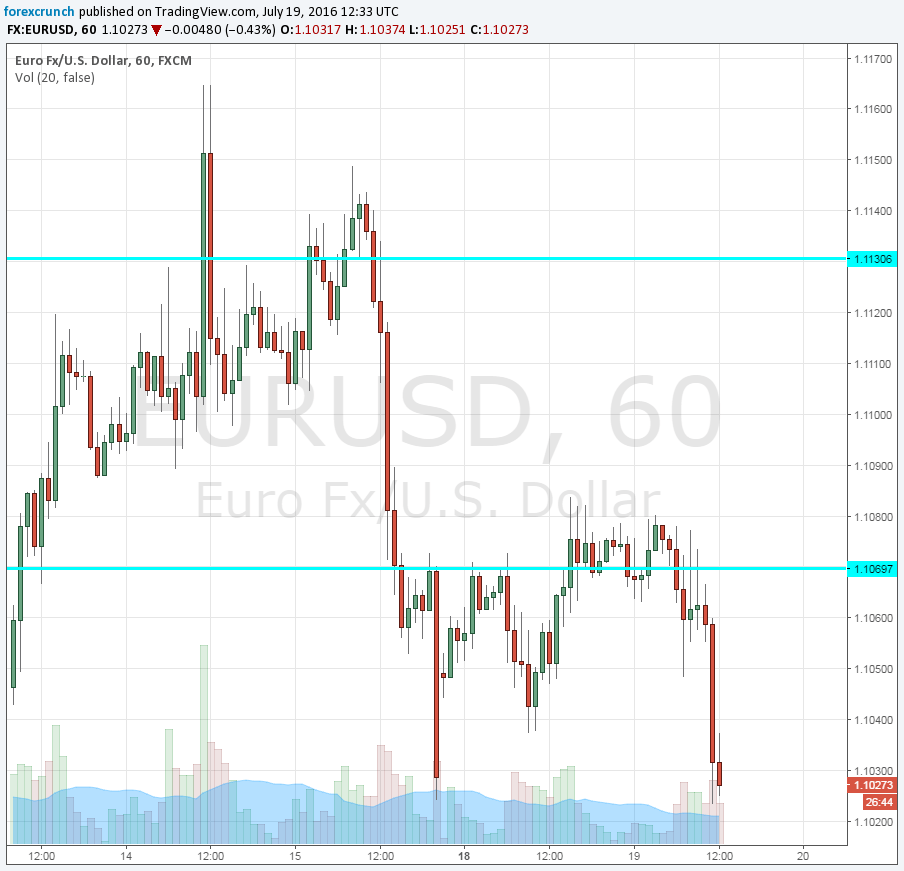

The US dollar is extending its gains, with EUR/USD edging lower. Also GBP/USD is lower and USD/JPY is higher. This is a pure dollar-related move rather than a “risk off” one. Commodity currencies were already on the fall beforehand.

US housing starts were expected to rise from 1.164 million (annualized) in My to 1.17 in June, a minor change. Also building permits carried similar expectations for a small rise from 1.136 to 1.15 million.

The US dollar was looking stronger across the board. This is due to a series of factors, with worries about global growth returning to the scene.

The housing sector is well correlated to growth in general, as we know so well from the 2008 financial meltdown. The sector has been gradually improving.

US bond yields are still looking good despite recent falls. They are still in positive ground and well above 1% for 10 years. This is very different than the negative numbers seen in Germany, Japan and Switzerland. In the UK, yields are below 1%.

More: A Paradigm Shift Is Underway For EUR: How To Trade It? – BofA Merrill

Here is EUR/USD leaning lower: