Just over 100 days towards the US presidential elections, and the race is becoming tighter, much tighter. Republican nominee Donald Trump was closing the gap on Democrat Hillary Clinton already before the Republican convention in Cleveland. And now, it seems that the race is neck to neck.

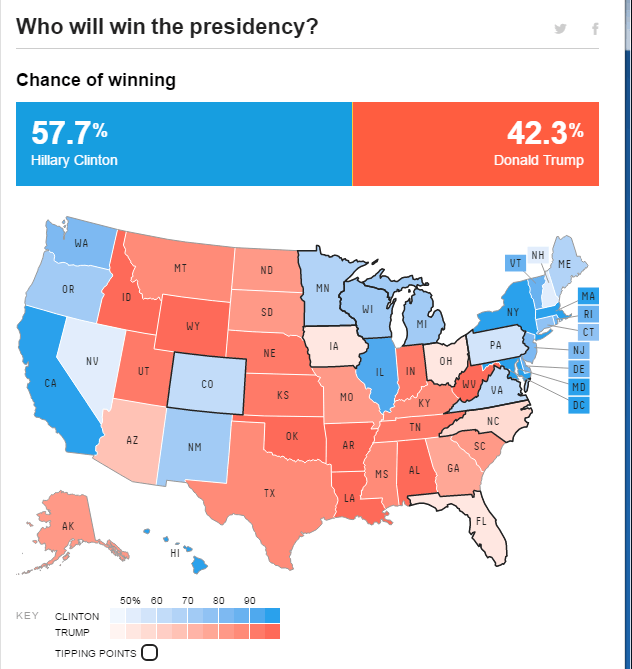

According to Nate Silver’s 538, the chances of Clinton winning have fallen from nearly 80% to 57.7%. The map shows Trump in the lead in Florida and Ohio. Clinton is still leading in the the overall chances to win and in the potential electoral college, but things are close.

Also the average of polls from RealClearPolitics shows a very narrow 2% lead fro Clinton, a gradual slide from 6.8% in late June, a month ago.

Elections and markets

Traders followed the primaries with interest, but it is hard to say that they had a material influence on markets. But things are heating up now, with the conventions highlighting the political scene.

And there could not be a starker difference, especially after the acceptance speech by Trump. Contrary to the optimistic and “can do” spirit of Americans, he painted a very gloomy picture: terror, chaos, crime, killings, were words that repeated themselves over and over. Hi only solution was a call to vote for him, without any real substance.

Trump has zig-zagged on so many issues, that his presidency is full of uncertainty. If elected and if he sticks to his anti-trade message, markets will not like it at all. Markets don’t like uncertainty either.

On the other hand, Clinton is certainly not an inspiring candidate, and she also partially backtracked on her support for trade agreements. However, as with her politics in general, this is an incremental change: she is not in favor of TTP in its current form. Her VP pick Tim” Kaine is certainly all for trade. And in terms of certainty, Clinton has been in the limelight for so many years,

Will markets react already now to the gloom portrayed by Trump in the convention? Will the rising uncertainty already hit a nerve?

More: Clinton Continuation vs. Donald Disruption – what the race means for currencies