The price of oil falls in the new month. WTI Crude oil slips under the round $40, losing around 4% and extending falls from last week. High oil inventories and no serious problems in production mean supply is in abundance. And where is demand going to come from? Well, the prospects of demand in the US don’t look too good, and that’s keeping the greenback restrained and limiting USD/CAD moves.

The Canadian dollar is losing ground, but showing a lot of resilience. USD/CAD cannot rise too much due to weak US indicators. USD/CAD is trading around 1.31. It is a rise of 60 pips that certainly fails to reflect the magnitude in the dive in oil. The loonie remains resilient. Resistance is at 1.3140 and 1.3240. Support is at the round number of 1.30.

The ISM Manufacturing PMI missed and this added to the poor GDP report from the so-called “global locomotive” which is the US economy.

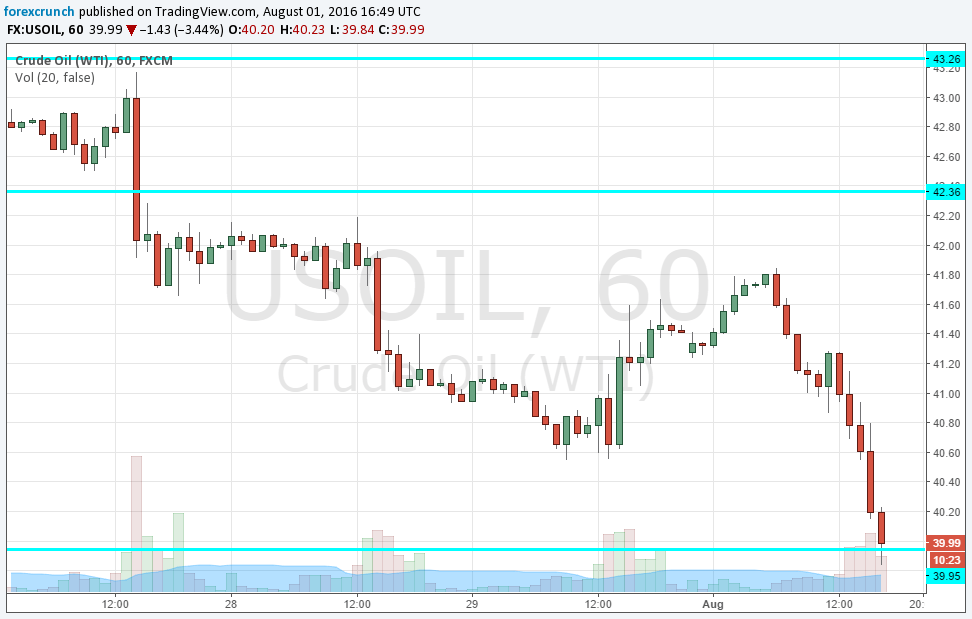

Here is the WTI hourly chart. Further support awaits at $37.87 a line that dates back to August 2015. Last year, the crash of the Chinese stock market led to a downfall in oil (among other assets). Further support is at $35. Resistance caps at $42.40.