EUR/USD is trading in range for a long time, but this range is not always clear. Here are two opinions about this range:

Here is their view, courtesy of eFXnews:

EUR/USD: Narrow 3 Big-Figure Range Intact Next Week; Staying Neutral – BTMU

EUR/USD – NEUTRAL BIAS – (1.1000-1.1300)

We set a relatively narrow three big-figure range with a neutral bias for EUR/USD last week and we see no reason really to change either for the week coming up. There is a pretty heavy economic calendar schedule in the US so there will be plenty of info to help shape monetary policy expectations.

Next week we will get the July CPI report and the release of the minutes from the July FOMC meeting. The overall risk is possibly that the markets strengthen the view that the Fed will indeed raise rates this year but we doubt to an extent that will result in any meaningful move lower for EUR/USD. The focus in the foreign exchange market is more on carry and hence if there is any move in FX in the week ahead may be more likely to come in higher yielding currencies versus the dollar that have moved more in recent weeks.

EUR/USD stability may well persist through to full trading activities resuming in early September.

EUR/USD: Stuck In 1.10-1.14 Range Over The Coming Months – Danske

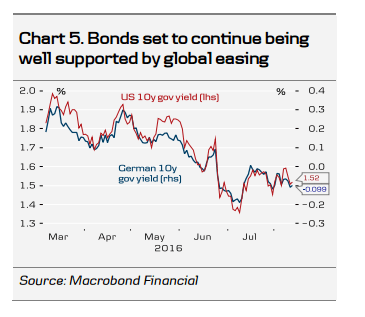

Bond yields have moved slightly sideways over the past month despite improving risk sentiment. Dovish central banks keep bonds bid and in Europe QE and a rising scarcity of bonds are driving the curves flatter. We expect this trend to continue.

Recent Fed comments suggest a very cautious stance from the Fed and we continue to expect it to delay the next hike to next year, although the probability of a hike in December has gone up following the latest strong job reports.

In FX markets, we have not seen the dip in EUR/USD we expected following the Brexit vote and it seems more likely now that we are stuck in a 1.10-1.14 range over the coming months.

In the medium term, we continue to see EUR/USD higher due to the same factors we have highlighted for a long time:

(a) the euro area-US current account differential is very high (hence flows favour the EUR) and (b) according to our medium-term valuation models (MEVA) EUR/USD is fundamentally cheap.

For lots more FX trades from major banks, sign up to eFXplus

By signing up to eFXplus via the link above, you are directly supporting Forex Crunch.