BOJ Governor Haruhiko Kuroda made a public appearance and talked about monetary policy. He left the door open to more easing via quantitative, qualitative and the interest rate tools. However, he did not seem to show any enthusiasm for significant action in the upcoming meeting later this month.

USD/JPY is slipping within the 103 handle, trading at 103.36 at the time of writing.

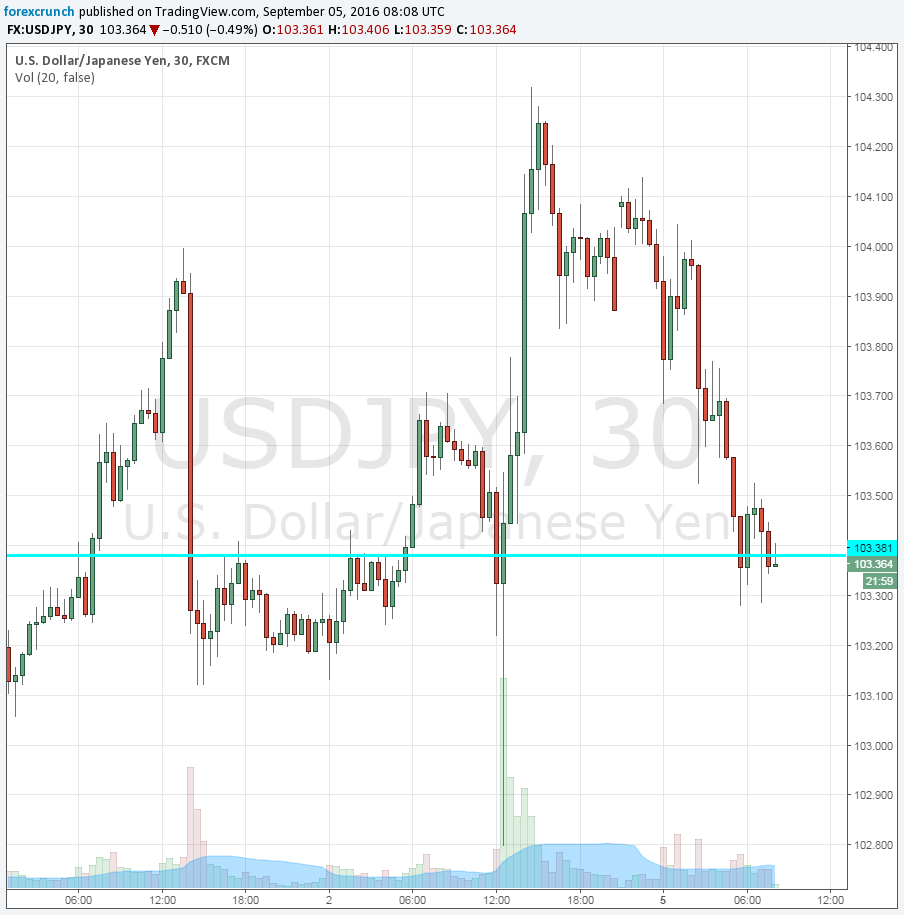

Dollar/Yen had a very exciting Friday, on the back of the US Non-Farm Payrolls report. The US gained fewer jobs than expected in August and wage growth was also underwhelming. The initial reaction was a significant drop in the dollar, with a move all the way down to 102.40. However, the greenback recovered, including against the yen, with the pair topping 104 in a quick turnaround.

The pair started the week above the 104 level but could not hold on. In addition to the aforementioned mixed message from Kuroda, the other side of the pair is also contributing to the move. The USD is on the slide once again.

Support awaits at 102.40, followed by 101.70 and 100.80. Resistance is at 104.20 and 105. Here is the USD/JPY 30 minute chart.

More: Scenarios For September BoJ MPM & USD/JPY Targets – Deutsche Bank