The Canadian dollar enjoyed some strength of late, or was it dollar weakness? The Bank of Canada convenes to make its decision. Here are three previews:

Here is their view, courtesy of eFXnews:

BoC To Stay The Course; USD/CAD Dips A Buying Opportunity – Credit Agricole

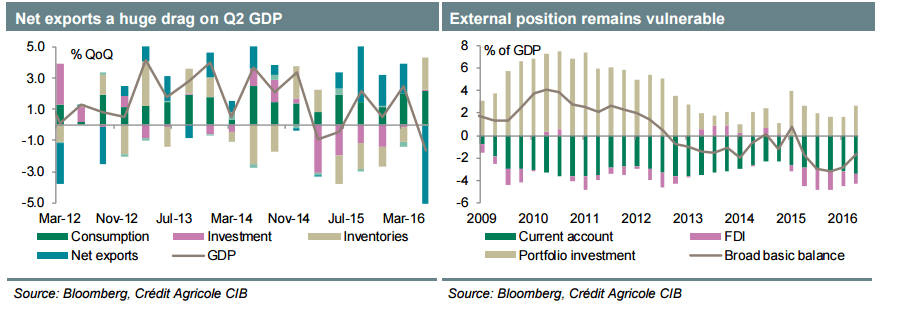

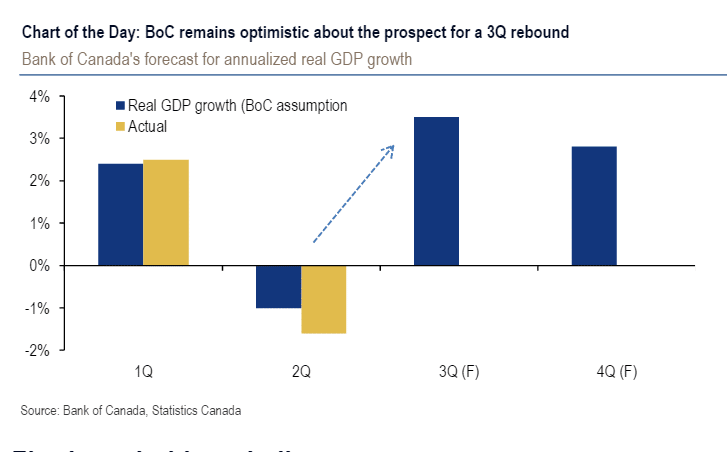

Q2 GDP fell by 1.6% QoQ, confirming a significant slowdown in growth even after accounting for the impact of the Fort McMurray wildfire. Without the updated macroeconomic projections we believe the BoC will mainly stay the course at the September meeting.

There should be some acknowledgement of an even Q2 GDP result than the central bank had been expecting but the BoC will wait until the October monetary policy report before considering any changes to the forward guidance or changing its assessment that the “overall balance of risks remains within the zone for which the current stance of monetary policy is appropriate”.

Going forward the BoC’s margin for error is quite small in our view. With potential growth of about 1.5%, it will take a GDP expansion of well above 3% during the second half of the year to make any meaningful impact on reducing the output gap. This means that BoC may need to change its message in October if incoming data disappoints.

Near-term volatility in USD/CAD is still mainly driven by external factors and with crude likely to remain under USD50/bl we continue to see dips in USD/CAD below 1.30 as buying opportunities.

CAD: BoC On Hold, Employment Report In Sight – Barclays

On Wednesday, we expect the BoC to leave its overnight rate target unchanged at 0.5%, in line with consensus. The economy contracted 1.6% y/y in Q2, more than what the BoC had anticipated, due to a weakness in exports, business investment, and oil and mining. However, monthly GDP rebounded in June (0.6% m/m), supported by the recovery in the oil sector following the wildfires and evacuation at Fort McMurray in May.

Despite the larger Q2 contraction, the BoC’s narrative of a high rebound is supported by the June GDP print, which signals an improvement in Q3. Furthermore, the trade balance deficit narrowed in July with an increase in exports, supporting the BoC’s narrative that non-energy exports are leading the recovery, keeping risks to inflation balanced. We believe the bank is reluctant to cut rates, as concerns about high household indebtedness and elevated house prices in Toronto, and Vancouver keeps mounting.

Markets will be focused on the August employment report on Friday after the previous two reports showed negative job creation. The resilience of consumption is the main bright spot in the Canadian economy, and sustained weakness in the labor market can signal weaker consumption ahead.

Other data releases include August Ivey PMI (Wednesday) and housing starts (Friday).

BoC To ‘Keep The Message Simple’: 3 Things To Keep In Mind – BofA Merrill

Firmly on hold, we believe.

Despite faltering growth and anemic hiring, we expect the Bank of Canada to remain on hold at their September policy meeting. This session will not include a Monetary Policy Report or press conference, so we think the BoC will likely keep the message simple.

There are three important points to keep in mind:

First, the drop in 2Q GDP was expected. The BoC‘s 2Q forecast was -1.0% in anticipation of drag from forest fires. Although the data have come in weaker than anticipated with evidence that sectors outside of energy were soft, we still expect the BoC to mostly shrug this off as noise.

Second, although weak growth suggests more slack in the economy, the BoC has frequently trimmed their estimate of potential growth during periods of declining CapEx. Thus, we assume the BoC will not get too hung up on precisely measuring how much slack has been generated in 2Q.

Third, housing imbalances remain on the BoC‘s mind. But it sees monetary policy as the last line of defense, so we do not expect any hawkish signals. Add it all up and this meeting should be a bit of a snoozer.

Eventual upside for USD-CAD

With a BoC likely on hold and a Fed potentially hiking at the end of the year, USDCAD should see some upside over the rest of the year, in our view. Despite the importance of the core oil fundamental for CAD as a commodity currency, the key shifting factor has been the renewed importance of rate differentials for Canada on both sides of the border. In general, rates have become a renewed source of concern for CAD movements since the crisis.

However, this year, policy differentials as expressed through rate differentials became that much more important given the appearance at the beginning of the year that the Bank of Canada was about to cut 25bp to 0.25%, which of course would have caused markets to contemplate the next move to unconventional measures at the zero lower bound or a move into quantitative easing. The new Canadian government‘s decision for fiscal easing in the spring also took off pressure from the BoC to ease, also taking weight off the currency.

Of course, rates have not always been a major driving force, and had been stagnant for a while after the crisis. But when we include both rate differentials and oil prices in standard regression models, we see USDCAD being more fairly valued in the lower-to-mid 1.30s.

Consequently, given our overall market call of expecting a Fed rate hike eventually this year and some near-term oil weakness, we still look for some further USD upside over the rest of the year. As in many places in our FX outlook, the fundamental difference between our forecasts and the market is our expectations of a moderately more hawkish Fed.

For USD/CAD, in particular, the recent stalling in non-energy export growth is likely to help give the BoC pause. Still, we probably need to see the market price in a more sustained path of Fed hikes to knock us from the market‘s current complacency. Otherwise, CAD may be range bound, caught between the tug of war of commodity valuation and still divergent monetary policies.

For lots more FX trades from major banks, sign up to eFXplus

By signing up to eFXplus via the link above, you are directly supporting Forex Crunch.