It’s not a happy Monday in stock markets, and this has implications for currencies as well. The ultimate haven currency which is the Japanese yen is on a roll, while commodity currencies are sold off.

Why has fear taken over?

Stocks slide on Fed Fear

The stock market falls already began on Friday. Speculation that the Fed might still raise rates in September crept in once again. One of the reasons is the relatively late scheduling of a speech by Lael Brainard. The permanent FOMC voter is a known dove, and she makes a public appearance later today at 17:00 GMT.

Some speculate that she will be hawkish in the speech. When a dove makes a special speech and turns hawkish, that would serve as the smoking gun for a rate hike coming soon. She is also the last to speak before the “quiet period” ahead of the Fed meeting.

Needless to say, we do not know what she will say and data has been negative this week. So, nothing is certain.

Clinton health worries

Another cause of worry was the political news from the US over the weekend. Hillary Clinton was rushed away from a 9/11 memorial ceremony after suffering the heat and also pneumonia. The viral video showing Clinton on the verge of collapse fueled rumors of her poor health, something that her rival Donald Trump hinted to.

The US presidential race has tightened in recent weeks. Clinton is the markets’ favorite, and Trump is feared, despite being a business person and a Republican.

Currency Reaction

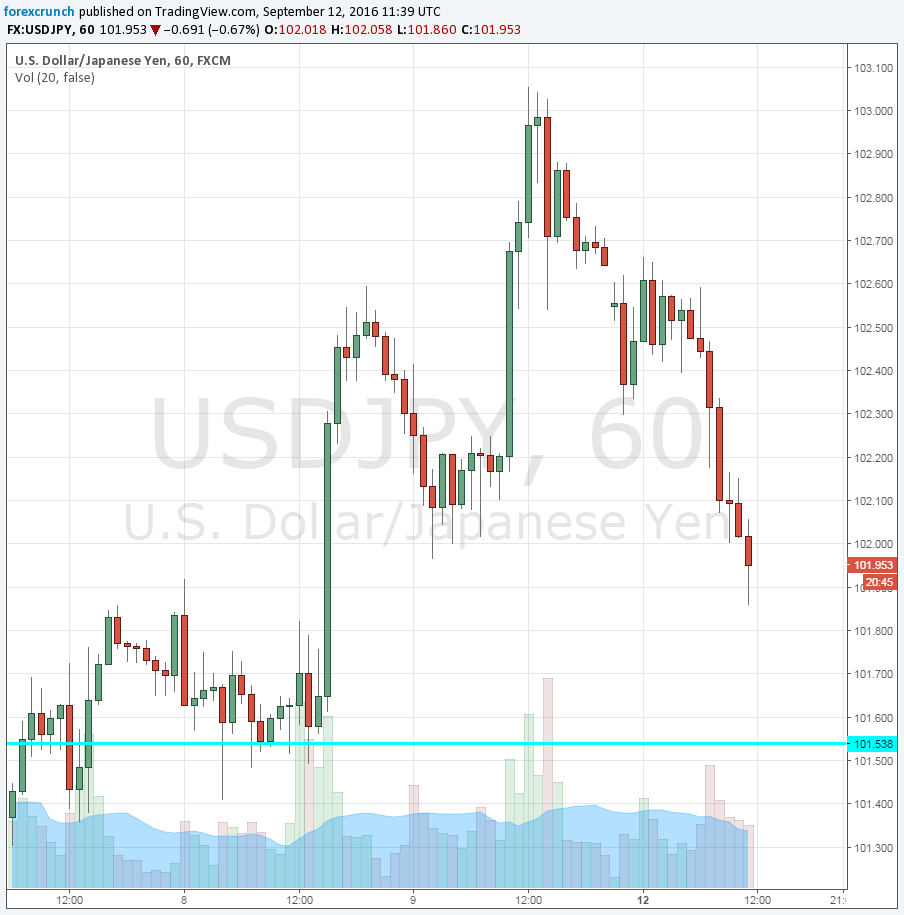

USD/JPY slipped under the 102 level, continuing the fall from the highs. Further support awaits at 101.50 and 100.70. Resistance is at 103.

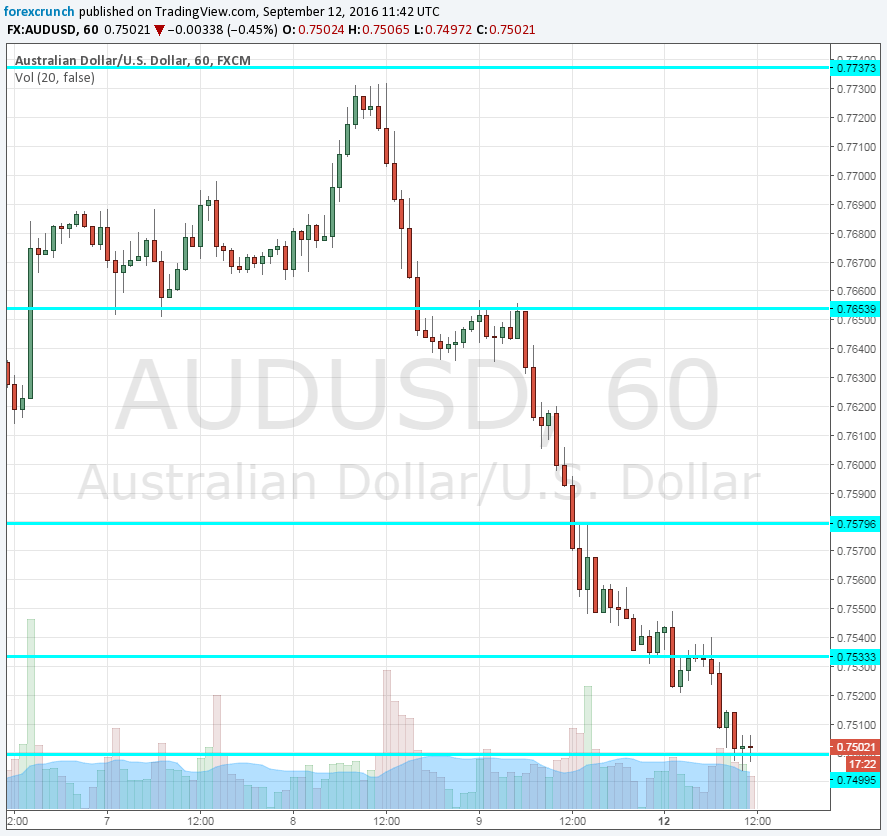

On the other side of the spectrum, we find commodity currencies. The Australian dollar has been the weakest link and extends previous falls.

AUD/USD trades just above 0.75, a round, support level. Further below, 0.7440 and 0.7375 provide further cushioning. On the topside, 0.76 and 0.7660 are lines of resistance.