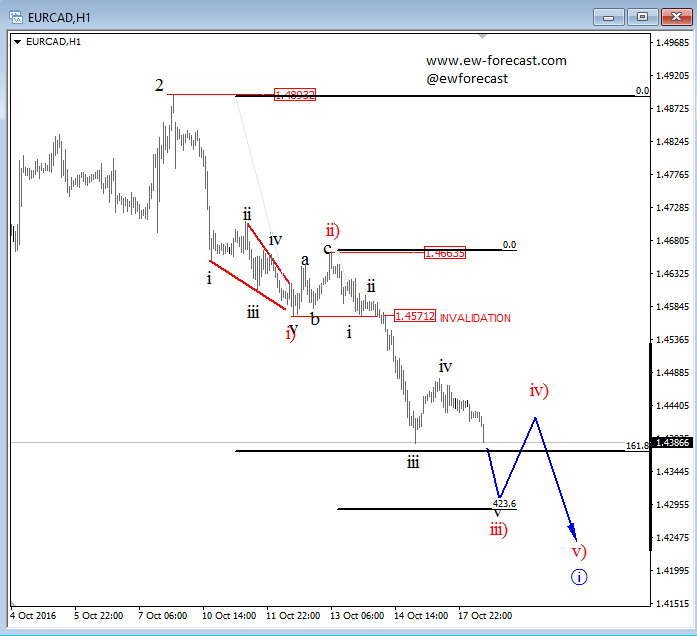

EURCAD

EURCAD keeps moving lower since Friday when we highlighted an important bearish pattern. Well, we were patiently waiting on that new low on the intraday chart to confirm we are in impulsive decline which looks like an extended wave iii) headed to 14300 now on the hourly chart . Interesting opportunities may then show up after wave four bounce.

EURCAD, 1H

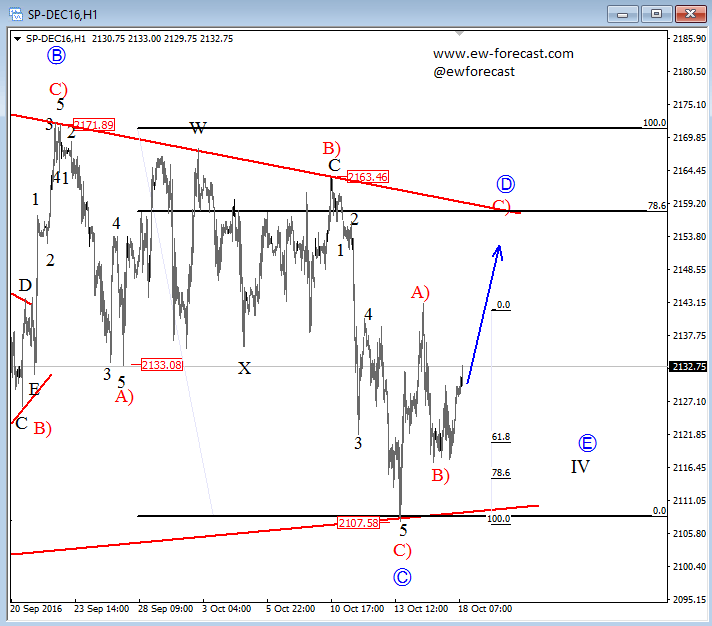

S&P500

E-mini S&P500 is turning nicely up now from 61.8-78.6% Fibonacci support levels where wave B) might have found a low. If that’s the case then stocks should stay bullish here for more gains up into wave D circled, towards the upper side of a triangle range, to 2160.

S&P500, 1H