The Fed said its word, and the hawks were heard. Here are the forecasts from SocGen:

Here is their view, courtesy of eFXnews:

The 10y real yield differential has just nudged through the wides we saw in early 2015, which coincided with the previous low for EUR/USD in this cycle. It all looks very neat and tidy. In nominal terms, the yield differential is wider than at any time since early 1989, when 10y Treasuries were around 9.25% and Bunds under 6.75%. But here, too, there are limits to how much further they can go. In 1990, they converged really fast. And among the things that don’t easily justify endless divergence, the recent convergence in nominal GDP growth between Europe and the US stands out.

We still expect to see EUR/USD reach parity between now and the French elections in April/May, but we also expect the euro to be stronger in a year’s time than it is today. It’s OK to embrace the idea of the Fed hiking a bit faster, and it’s OK to embrace the idea of the US getting a growth boost from a Trump administration. But a lot of that is already in the price. EUR/USD staying sustainably below parity still seems unlikely unless the elections in France throw up a major surprise.

For lots more FX trades from major banks, sign up to eFXplus

By signing up to eFXplus via the link above, you are directly supporting Forex Crunch.

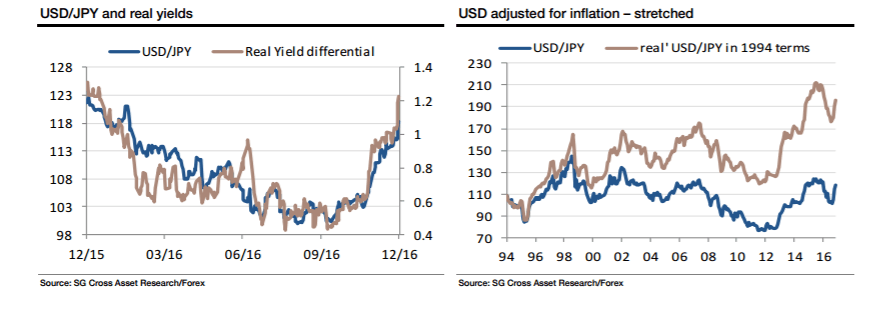

There has been an 80bp rise in real yields in the US relative to Japan since the summer, driving an 18% rise in USD/JPY. There’s more to go for, with the usual caveats. Firstly, there’s a limit to how high US real yields can climb before they hurt global risk sentiment, and secondly, in real terms, the yen is getting very cheap again. The second chart shows USD/JPY against a measure of the real USD/JPY since 1994, which is only meant to show how much the dollar has appreciated relative to the yen in real terms over the past 22 years. Japan will need to generate not just negative real yields and higher inflation expectations, but also sustainably higher inflation than the US or its other trading partners to justify USD/JPY going all that much further.

USD/JPY 120-125 looks set to be reached imminently, and somewhere in that range, the going is going to get a lot tougher.

For lots more FX trades from major banks, sign up to eFXplus

By signing up to eFXplus via the link above, you are directly supporting Forex Crunch.