One of the policies mentioned by Trump in his dollar-downing press conference has been a border tax. How will this impact currencies? The team at NAB explains:

Here is their view, courtesy of eFXnews:

Since Donald Trump’s election victory, speculation has intensified that a proposal for a so-called border adjustment tax would feature in the new Trump administration’s planned overhaul of the corporate tax regime.

What is a border tax adjustment?

A VAT (or GST) system, which operates in many countries but not the U.S, taxes consumption of goods and services sold inside a country regardless of their source of origin.

In taxing all domestic consumption it represents a tax on imports but not exports, for which firms do not have to levy VAT. A border adjustment tax is being touted as a way of leveling the playing field between imports and exports and strengthening demand for goods and services produced in the United States.

Under a border tax as proposed by Congressman Brady, U.S. companies would be denied a tax deduction from their revenues for the costs of imported goods.

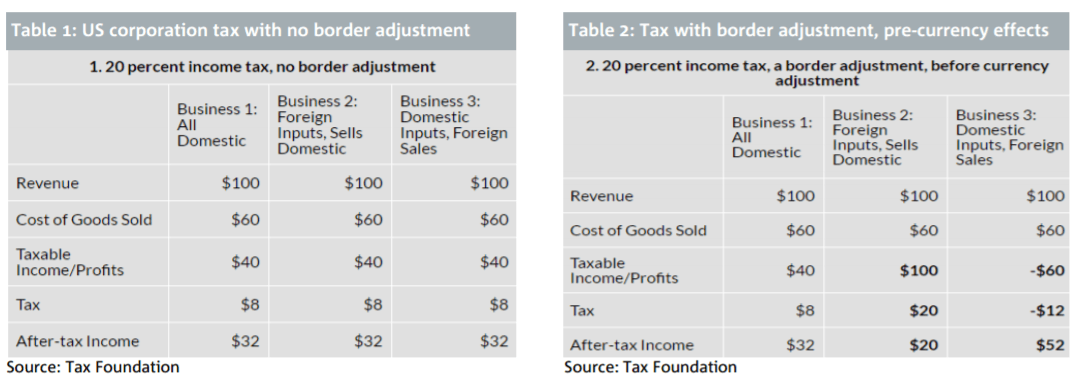

So in an extreme case where all of its inputs are imported and all sales are domestic, a U.S. firm’s taxable income would be equal to its gross revenue and charged at the prevailing corporate tax rate (expected to fall to somewhere between 15% and 25% from the current 35% under corporate tax reforms likely to be tabled for legislation later this year). At the same time, US companies who export overseas but have domestic input cost would pay no tax on their export revenue but receive a tax credit for the domestic costs associated with generating those exports. So a company whose revenue is all export-related but has only domestic costs would pay no tax on its revenue and receive a tax credit on its costs. See examples in Tables 1 & 2.

Hence, a border tax is often depicted as a tax on imports and subsidy for exports, thereby incentivizing U.S. companies to produce more at home and sell more abroad. If this happens, the US trade deficit would shrink (a GDP growth positive). Or looked at another way, consumption of domestic goods and services would rise as a result of import substitution.

For lots more FX trades from major banks, sign up to eFXplus

By signing up to eFXplus via the link above, you are directly supporting Forex Crunch.

The border tax question is a very big deal for the US dollar and which makes it a big deal for the Aussie dollar and Australia, so demanding our attention.

If a border tax means a much stronger US dollar, then it almost certainly mean a much weaker AUD. The imposition of a border tax, at last in the guise currently proposed, is not our base case, but the risk of Trump/Congress going ahead is far from trivial. As such, it needs to be highlighted as one significant upside USD/downside AUD risk to our forecast for AUD/USD dropping only to the high 0.60s in the coming year or so.