Inflation in the UK is slightly cooler than markets had anticipated. Prices dropped by 0.5% m-m as projected, but the y/y numbers are a miss. CPI is up 1.8% and core CPI remained stuck at 1.6%. Clothing store discounts are cited as the main reason for the weaker data.

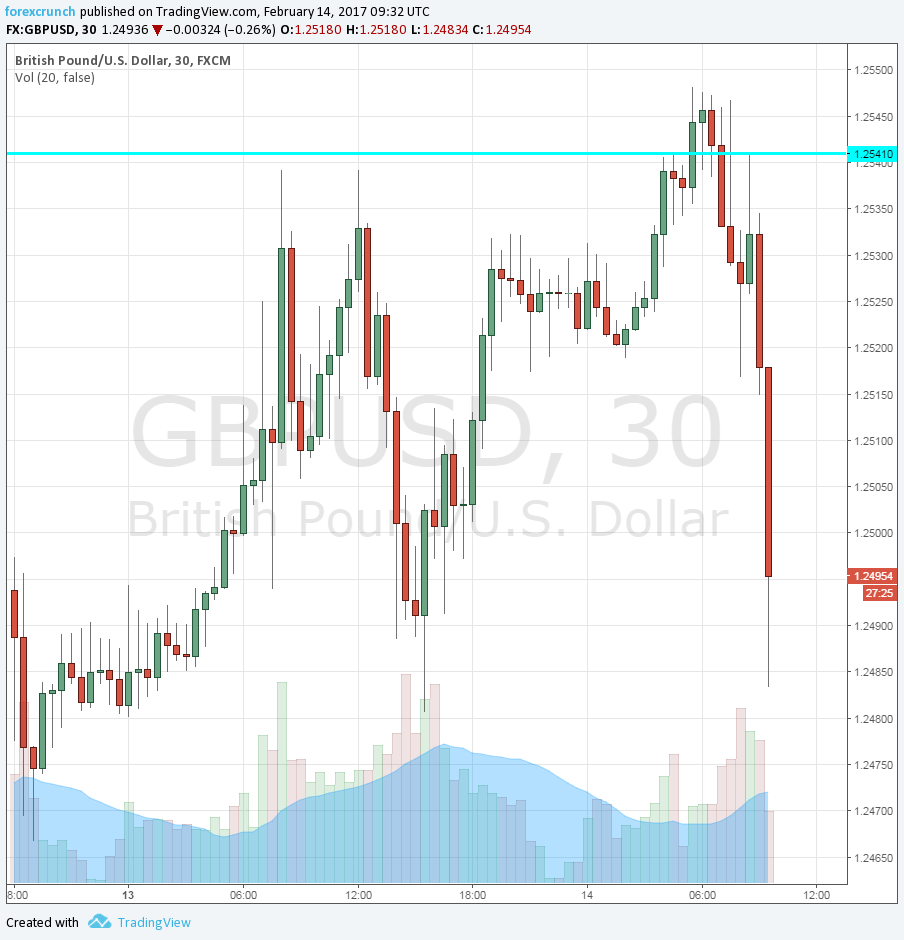

GBP/USD, which was already sliding, extended the falls and hit a new low of 1.2483. Update: the pair extends its falls to a new low of 1.2458.

Here is how it looks on the Sterling/dollar chart:

More: GBP: More Sensitive To Good News In The Near-Term – BTMU

Other figures:

- RPI is up 2.6%, below 2.8% expected and 2.5% last time.

- PPI Input is up 1.7%, above 1% expected and below 2.7% seen last time. PPI Output is up 0.6%.

- The House Price Index is up 7.2%, above 6.9% expected.

The United Kingdom was expected to report another rise in inflation. Headline CPI was expected to rise from 1.6% to 1.9% y/y in January 2017. Core inflation was predicted to rise from 1.6% to 1.8%.

GBP/USD was trading around 1.2520, down from a peak of 1.2548 earlier in the day. Front-running a release is quite common when it comes to UK publications. Are markets anticipating a somewhat weaker outcome?

The BOE would like to see lower inflation but would not want to raise rates to make it happen. Carney and co. would like to remain neutral.

More: GBP: ‘No Fallback Options For Hard Brexit’; We Stay Core Short Sterling – Deutsche Bank