Commodity currencies have been mixed of late. The team at SocGen identifies trends:

Here is their view, courtesy of eFXnews:

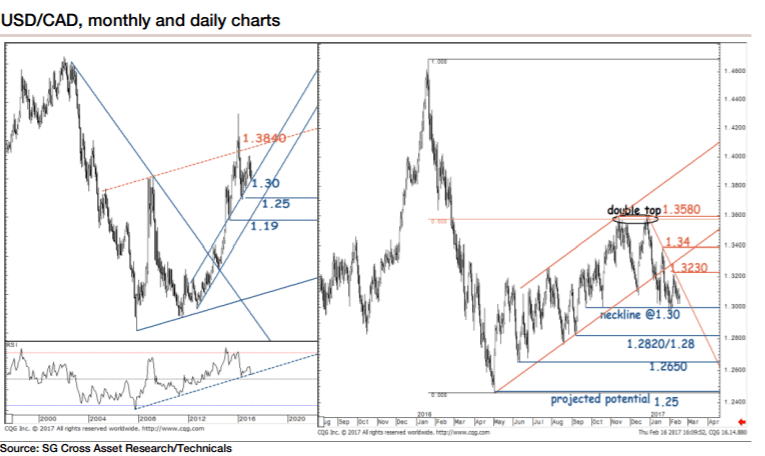

In a steady down move, the USD/CAD is approaching the neckline of the double top formation at 1.30, also the multiyear ascending channel limit. Monthly RSI is tentatively holding a support trend indicating 1.30 as a key level.

A break below will unfold the next leg of the down move towards 1.2820/1.28 and perhaps even towards the projected potential at 1.25, which also happens to be the 76.4% retracement from April 2015 lows. The late January high at 1.34 remains an important hurdle.

For lots more FX trades from major banks, sign up to eFXplus

By signing up to eFXplus via the link above, you are directly supporting Forex Crunch.

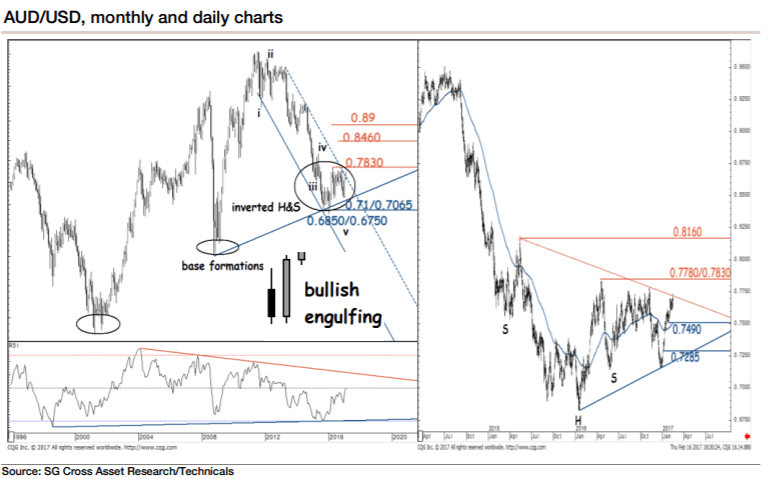

The AUD/USD has been evolving within a base formation in the form of an inverted head and shoulders since early 2015. Last month the pair formed a bullish engulfing and is currently probing the neckline of the pattern.

A retest of graphical levels at 0.7780/0.7830 looks on cards. A break above will mean a larger up move towards 0.8160, May 2015 highs. Near-term pullback, if there is any, should be cushioned at a 100-day MA at 0.7490.