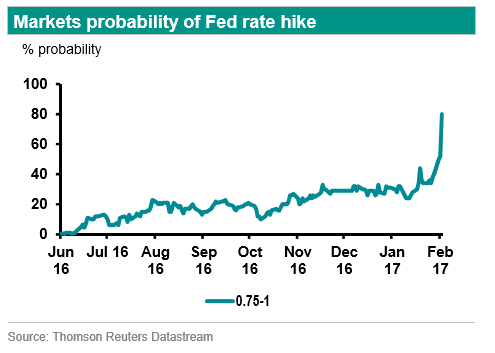

The odds for a rate hike from the Federal Reserve have risen significantly after Dudley’s speech. The team at ABN AMRO joins the March train:

Here is their view, courtesy of eFXnews:

We now expect the Fed to hike rates this month. The sharp year-to-date improvement in US business surveys signals the possibility of accelerating US growth in early 2017. Business surveys released so far in 2017 have been quite strong, with the January ISM manufacturing and non-manufacturing indices at or near one-year highs and consumer confidence surveys also trending up. Other data releases, including consumer spending, have also been stronger than expected.

We continue to forecast three rate hikes in 2017, but we have brought forward the next rate hike to March, while keeping the next two rate hikes in June and September.

The risks are tilted for a fourth rate hike, but this will depend crucially on the size and timing of the fiscal stimulus. Markets are currently pricing in two rate hikes this year.

For lots more FX trades from major banks, sign up to eFXplus

By signing up to eFXplus via the link above, you are directly supporting Forex Crunch.