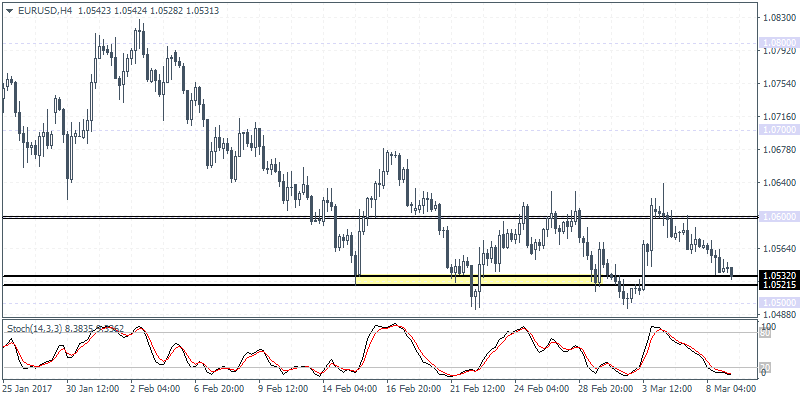

EURUSD intra-day analysis

EURUSD (1.0531): EURUSD is seen testing the support level at 1.0532 – 1.0521 on the 4-hour chart. A break down below this support level could signal further declines in store, while to the upside the gains could be limited to 1.0600. Thus, the EURUSD could continue to remain range bound in the near term as the single currency will also come under pressure from tomorrow’s non-farm payrolls report which is looking to show another solid month of hiring. Thus, despite any hawkish tilt from the ECB today the gains could likely come under pressure, if not with tomorrow’s NFP then next week’s FOMC meeting.

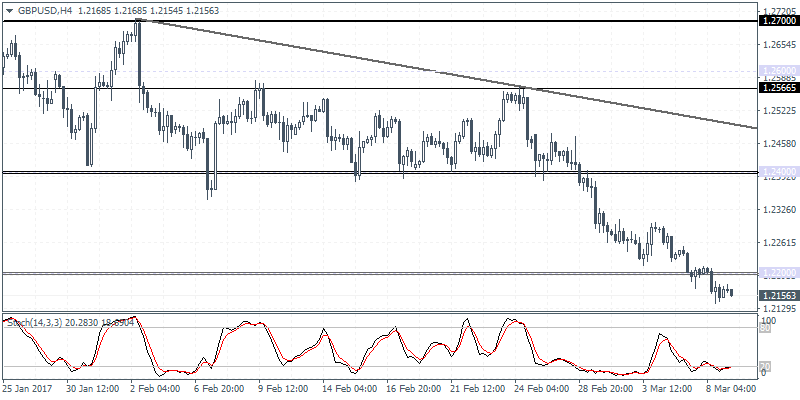

GBPUSD intra-day analysis

GBPUSD (1.2156): GBPUSD breached the 1.2200 support level this week and could now be seen extending the declines towards 1.2100 which will mark the completion of the descending triangle breakout. The declines came about as the UK government presented its annual budget and just the day before, the Brexit bill was defeated in the House of Lords, which means that the British PM must put the Brexit bill and any negotiations to parliamentary approval. The GBPUSD could see some respite after prices fall to 1.2100 where support could be found in the near term.

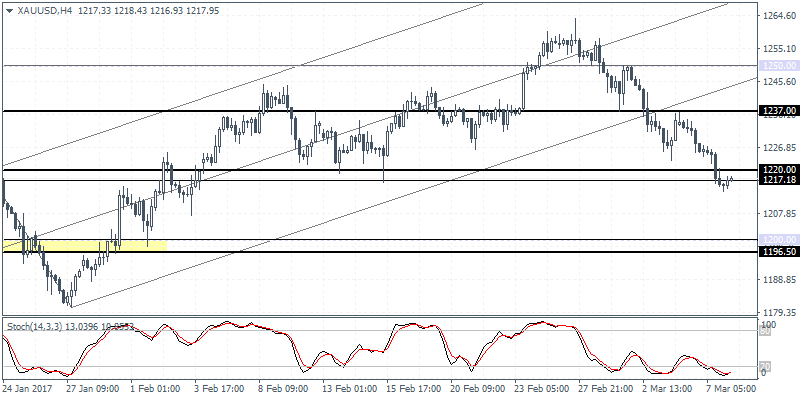

XAUUSD intra-day analysis

XAUUSD (1217.95): Gold prices have extended the declines and could now be testing the $1200.00 support any time this week. However, the declines in gold prices could see a temporary pause with price action likely to be limited to the 1235 – 1200 regions in the near term. However, next week’s political uncertainty from Europe, as the Netherlands goes to polls will be seen as a key event that could keep gold prices from depreciating any further. Still, the bias remains flat for the moment with 1235 and 1200 levels to contain gold prices for now.