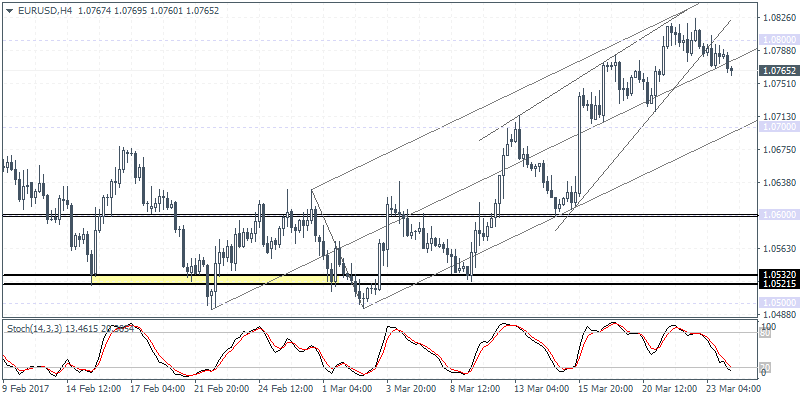

EURUSD intra-day analysis

EURUSD (1.0765): EURUSD is looking to giving up its gains following the rally to 1.0800 which is proving to be a strong resistance level that previously kept a lid on prices in late January and early February and previously around November last year. On the daily chart, the EURUSD price action is forming an ascending triangle pattern, and a break out above 1.0800 could signal further upside towards 1.1200. On the 4-hour chart, the declines in EURUSD came out as expected and we figure that the downside will be towards 1.0700 support initially. A break down below 1.0700 could signal a move to 1.0600 which could potentially invalidate the daily chart’s bullish ascending triangle pattern.

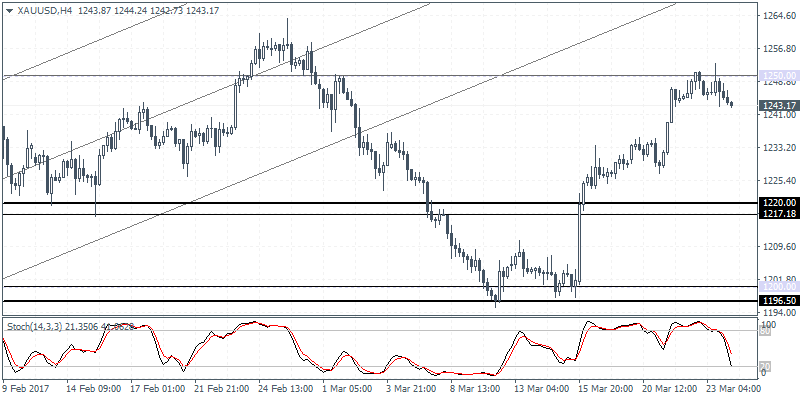

XAUUSD intra-day analysis

XAUUSD (1243.17): Gold prices have managed to post a steady rally towards the resistance level at 1250.00. However, price action is showing early signs of possible weakness to the upside. We can, therefore, expect to see price action continue to remain range bound within 1250 resistance and 1220 support, with one of the two levels likely to give way for the further continuation of the trend. On the 4-hour chart, the Stochastics are currently moving closer to the oversold levels of 20 and could pose a risk of a short-term reversal. This indicates that gold prices could possible see a short term move back to the upside. Failure to post higher highs above 1250 will be the cue for traders as gold prices could be looking to settle lower in the coming weeks.

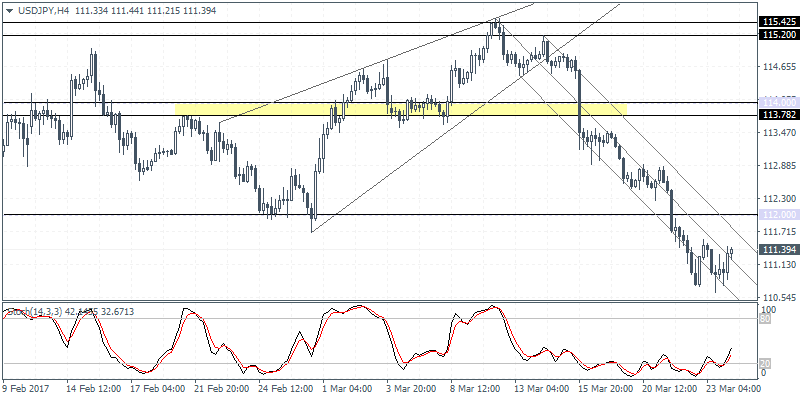

USDJPY intra-day analysis

USDJPY (111.39): USDJPY is continuing to consolidation near the 111.00 – 110.75 levels for the past few days. This sideways price action is signaling a break out in the near term. Above 111.00, USDJPY will be facing the resistance level at 112.00 and only above a successful break above 112.00 can one expect the bullish momentum to continue to push the dollar towards 113.78 price level where there is a major resistance zone. In the near term, we can expect the sideways price action to however continue and today’s U.S. durable goods orders and the possible healthcare vote will likely be the catalyst that could push prices higher.