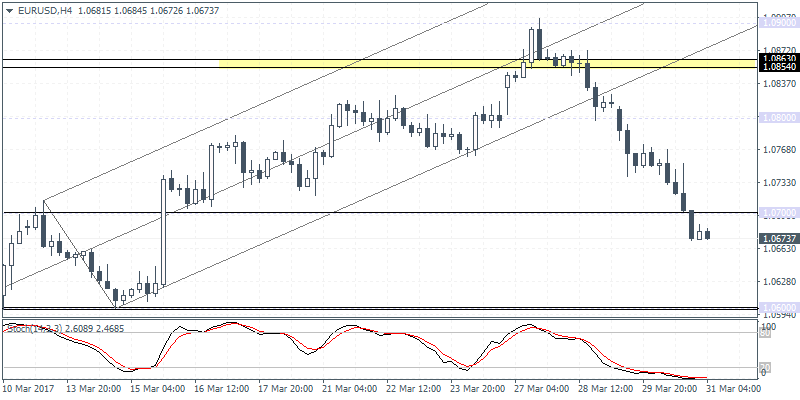

EURUSD intra-day analysis

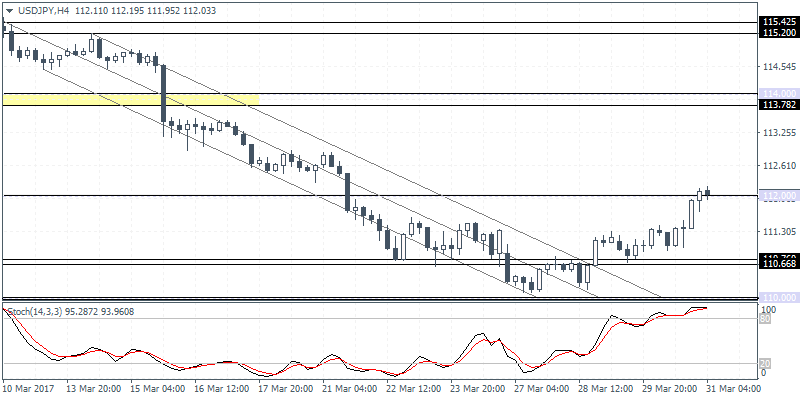

USDJPY intra-day analysis

USDJPY (112.03): USDJPY was very bullish in yesterday’s trading as prices rallied to close at a 7-day high at 111.92. We can anticipate a near-term pullback in prices as prices are currently trading near the 112.00 resistance level. Comparing the price action to the Stochastics, we also notice a strong hidden bearish divergence. This could see a near term decline to a potential support at 111.20 – 111.30 region. A decline to this level could potentially signal a renewed bullish momentum that could push USDJPY past the 112.00 resistance and towards 113.80.

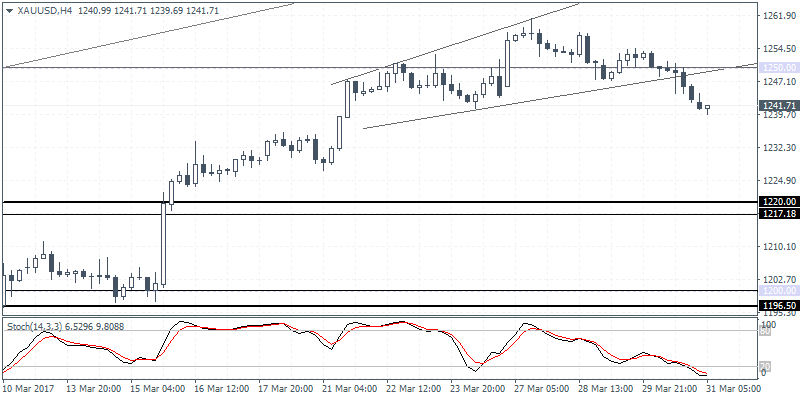

XAUUSD intra-day analysis

XAUUSD (1241.71): Gold prices eventually turned weaker yesterday after the price was seen consolidating near 1250.00 handle and as expected on the 4-hour chart price broke down from the broadening wedge pattern. In the near term price action is likely to see a short-term bounce back as there is scope for the price to retest the 1250.00 level to form a resistance.

Establishing resistance near the 1250.00 handle in gold could signal a continuation to the downside as gold prices will be targeting 1220.00 support in the short term.