Remains on high ground after 57.7 points in February. This fresh figure for March is a first hint towards the Non-Farm Payrolls report on Friday. The employment component is up to 58.9 points, an encouraging figure in comparison with the 54.2 seen in February, boding well for the jobs report.

New orders are slightly lower at 64.5 and prices paid tick up to 70.5 points, a steaming hot level. Is manufacturing experiencing overheating inflation?

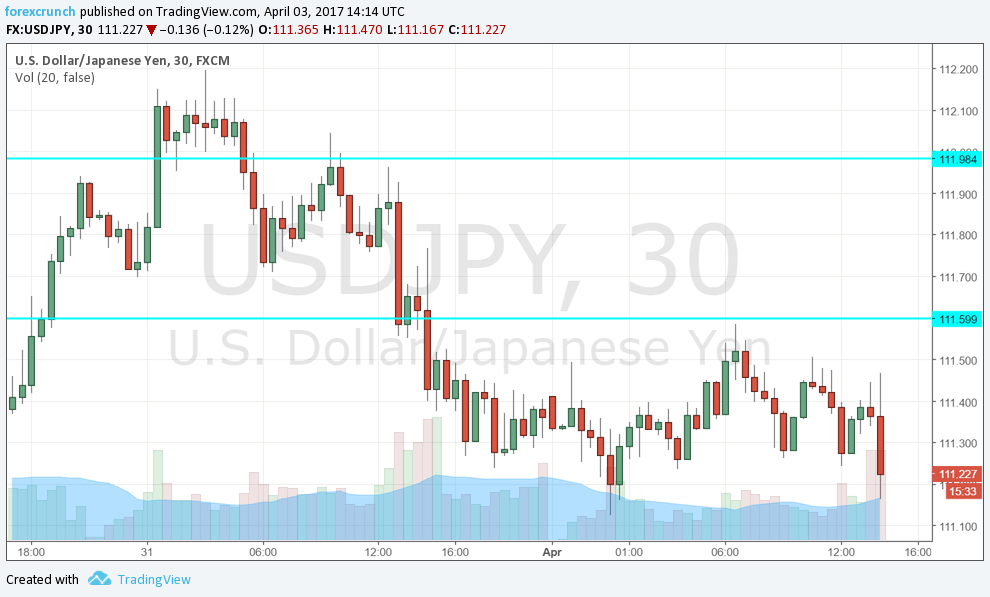

The US dollar is losing some ground on the publication, ticking lower across the board, yet within the previous ranges. Why is the dollar falling? So far, it looks like a correction to previous gains rather than something substantial.

Update: a blast in Saint Petersburg, Russia, is weighing on sentiment. This is helpful to the safe-haven Japanese yen. Another reason for the dollar weakness comes from car sales. Sales of vehicles dropped in March according to data released by various car companies.

Earlier, Markit’s final manufacturing PMI was released and it was a small downgrade: from 53.4 to 53.3 points. Construction spending rose by 0.8%. While the print is below expectations of 1%, it comes on top of an upwards revision to last month.

Here is how the move looks on USD/JPY. This pair often best reflects movements in the dollar. Note that it is sliding within the range.

More: The basics of technical analysis explained in under 5 minutes