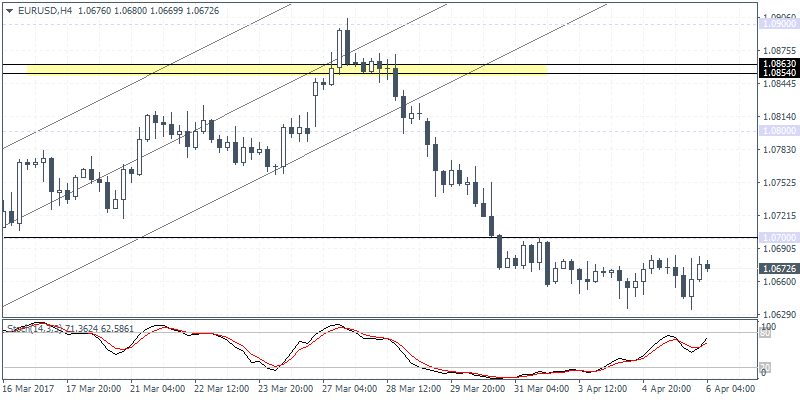

EURUSD intra-day analysis

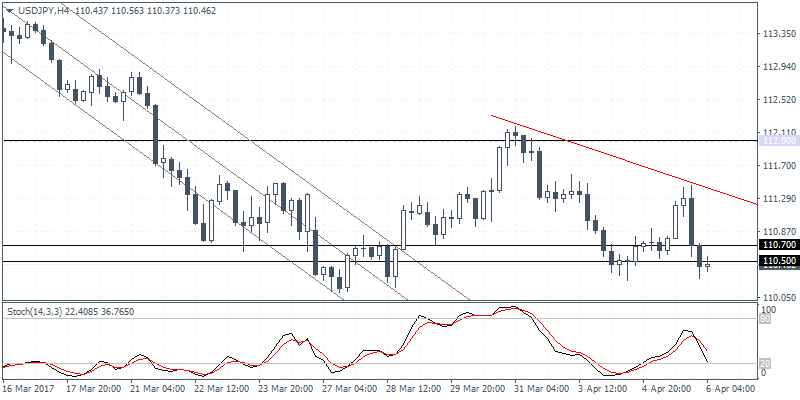

USDJPY intra-day analysis

USDJPY (110.46): USDJPY attempt’s to reverse off 11.50 – 110.70 support failed as prices fell back to the support yesterday. Still, there is potential to see further upside with a breakout from the falling trend line. Resistance at 112.00 could be tested in the near term with further gains coming above this level. Despite the modestly bullish outlook in USDJPY, there are significant risks of a decline to 110.00. However on the 4-hour chart, there is a possible bullish divergence that is formed with the lows in price reflected by the higher lows on the Stochastics oscillator.

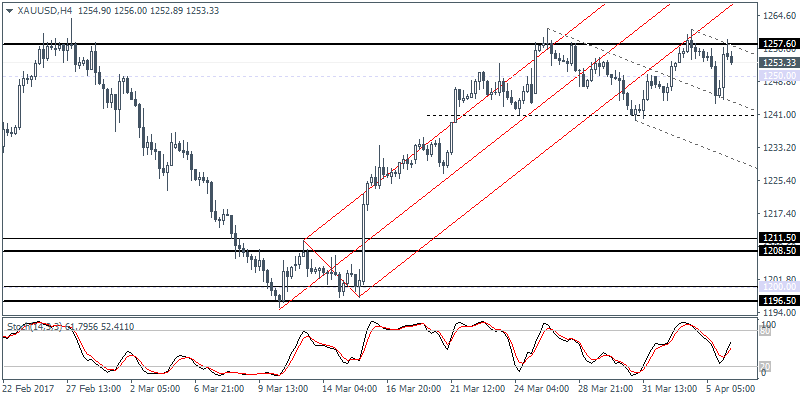

XAUUSD intra-day analysis

XAUUSD (1253.33): Gold prices continue to remain hovering near the 1260.00 region but repeated attempts on an intra-week basis to breach 1257 – 1260 levels have failed. This could possible indicate a near term weakness in price.

Initial support at 1250 can be tested with further downside likely to extend towards the 1210 – 1200 levels where support is most likely to be tested. With the U.S. payrolls due tomorrow, gold prices could remain range bound for the near term.