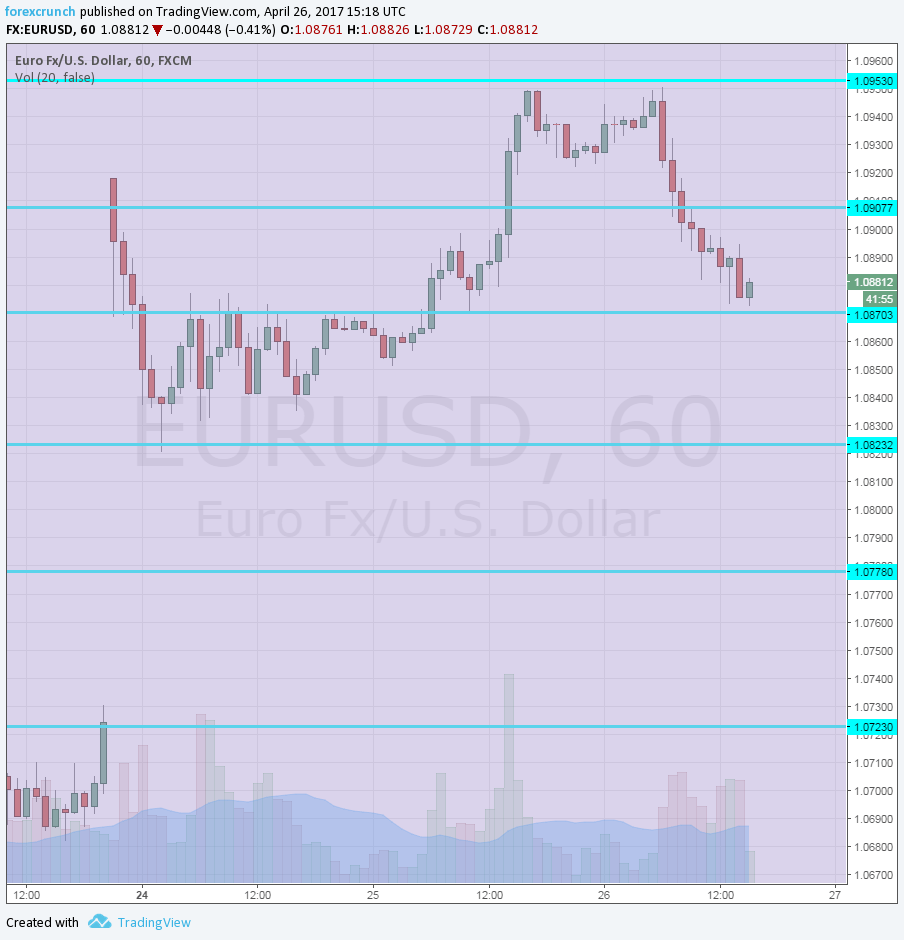

EUR/USD certainly has an interesting week. It began with a significant 200 pip Sunday gap on the French elections, reaching 1.0930. When things cooled down, it found itself at support some 100 pips lower. That 1.0830 level worked as the initial 2017 high.

It moved up from there, settling above 1.0870, the December 2016 swing peak. Another move higher saw the pair challenge 1.0950, a low point during July 2016. A second move triggered a double top at that 1.0950 level.

And now the pair falls from high resistance to low support at 1.0870 once again. The technical behavior of the pair is quite impressive.

Here is how it looks on the one-hour chart and then an explanation to the most recent downfall.

3 reasons for the EUR/USD slide

- French poll ticking lower: The daily Opinionway poll shows centrist Emmanuel Macron losing one percentage point to extremist Marine Le Pen. This still leaves him at 60% against 40%, but markets are nervous. Since election night, the performance of Le Pen has seemed wiser than Macron’s. It is not over until is over, on May 7th. The actual gap will likely be much smaller.

- Trump’s taxes: There is a lot of uncertainty about the tax plan that Trump is about to announce. There are bigger doubts about what will actually pass Congress. Nevertheless, cutting the corporate tax rate from 35% to 15% looks like a boon for the US economy. Until reality bites, this helps the US dollar.

- ECB fear: After some hope for a more optimistic ECB meeting tomorrow, it’s time for profit taking and curbing the enthusiasm. It is important to note that Draghi has been dovish in the past, and there is no guarantee that he will be optimistic now.

More: ECB Preview: seeing the glass half full? 3 scenarios

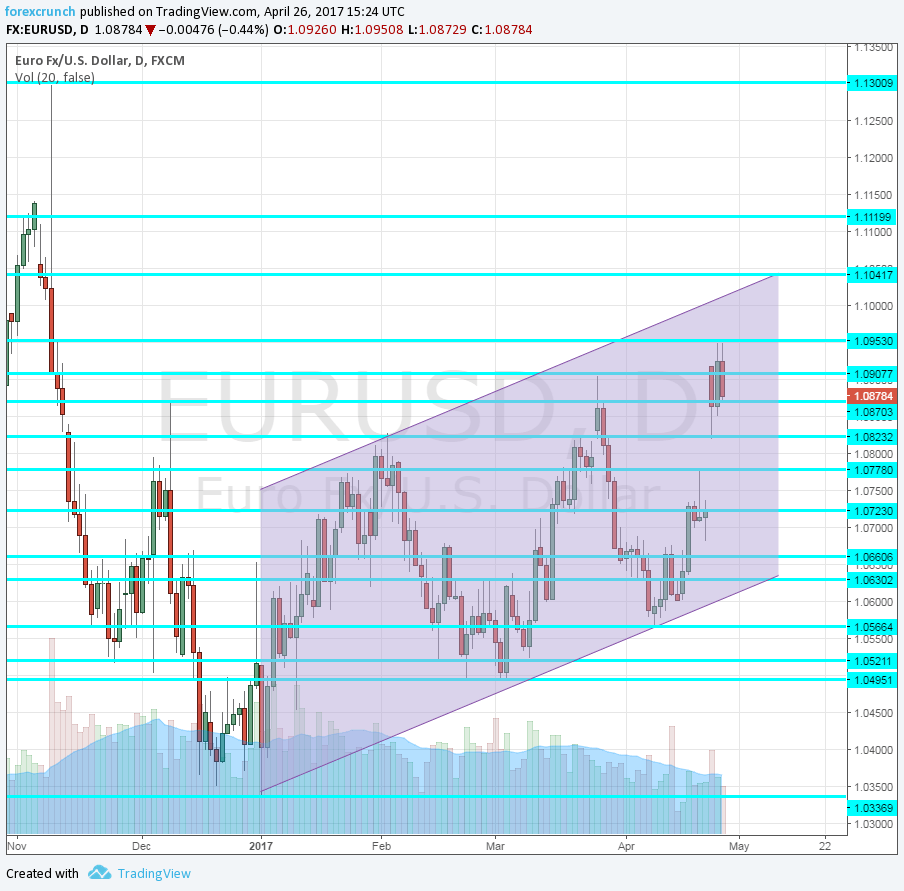

The bigger picture looks favorable for EUR/USD. The pair continues riding higher in the channel, posting higher lows as well as lower highs.

Here is the daily chart. These dips may be buying opportunities