EUR/USD failed to move higher and eventually dropped after the Fed raised rates. Has the trend changed? The second round of the French Parliamentary elections and PMIs stand out. Here is an outlook for the highlights of this week and an updated technical analysis for EUR/USD.

French President Macron is en route to an absolute majority in the French Parliament, enabling him to enact reforms. The euro-zone saw a better than expected rise in employment, but the German ZEW business sentiment disappointed and dropped. In the US, the Fed not only raised rates but disregarded lower inflation, expressing confidence that was also seen in the US dollar.

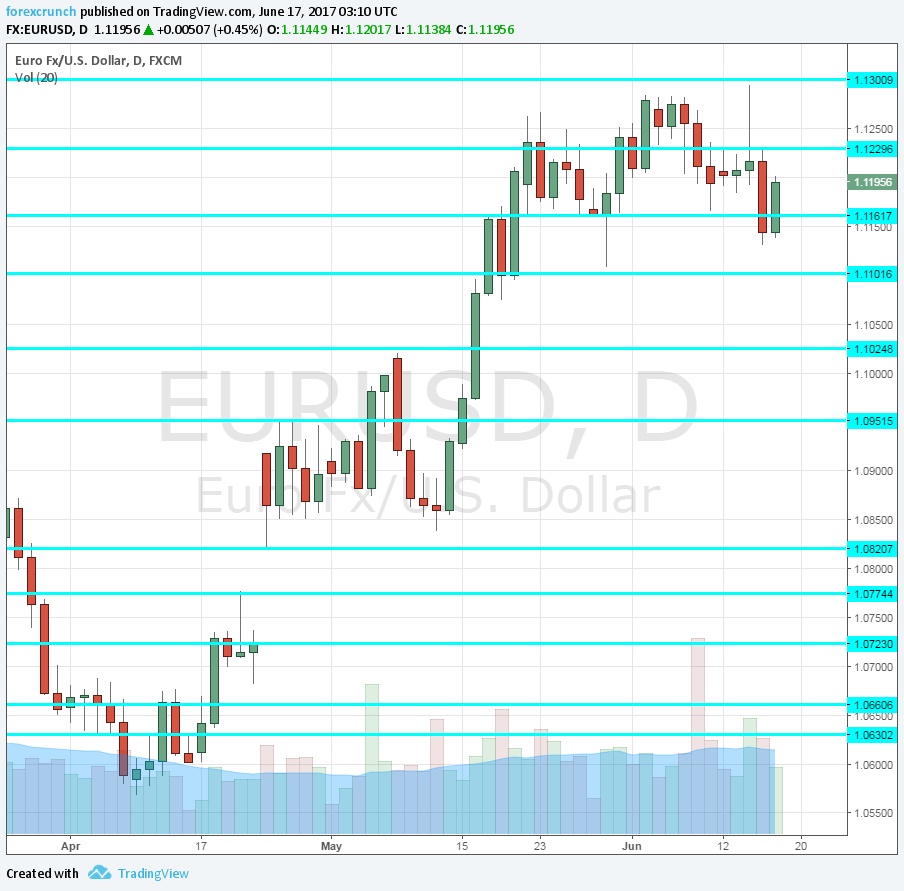

[do action=”autoupdate” tag=”EURUSDUpdate”/]EUR/USD daily chart with support and resistance lines on it. Click to enlarge:

- German PPI: Tuesday, 6:00. Producer prices beat expectations back in April with a rise of 0.4% in Germany. Prices at factory gates eventually reach consumer prices. This time, a drop of 0.1% is projected.

- Current Account: Tuesday, 8:00. Similar to the trade balance numbers, the eurozone’s current account is in a surplus thanks to German exports. A surplus of 34.1 billion has been reported in March. We now get the figures for April. A narrower surplus of 31.3 billion is expected.

- ECB Economic Bulletin: Thursday, 8:00. Two weeks after the ECB changed its stance on downside risks, the central bank releases the data that led to its decision. The ECB usually doesn’t provide big surprises in this bulletin, but the data can still move markets.

- Consumer Confidence: Thursday, 14:00. The official measure of consumer confidence is still negative, reflecting pessimism, but improving gradually. The score increased from -6 to -3 in a gradual manner, reflecting the improvement. This time the score is expected to remain unchanged at -3.

- Flash PMIs: Friday, 7:00 for France, 7:30 for Germany and 8:00 for the whole euro-zone. Markit publishes preliminary purchasing managers’ indices for the month of June. Back in May, the French manufacturing PMI stood at 53.8 points, reflecting OK growth. A rise to 54.1 is predicted. Any score above 50 represents expansion. The services sector enjoyed a higher score of 57.2 points and a minor slide to 57.1 is predicted. In Germany, manufacturing was looking great with 59.5 and a slide to 59.1 is forecast. Services lagged behind with 55.4 points and the same score is on the cards now. The euro-zone had a score of 57 in manufacturing and 56.3 in services. Both are expected to tick down by 0.1 each.

- Belgian NBB Business Climate: Friday, 13:00 .The 6000-strong survey comes from a small country but is considered a good barometer for the wider continent. A disappointing drop to -1.1 was seen in May. A small improvement to -0.8 is predicted now.

* All times are GMT

EUR/USD Technical Analysis

Euro/dollar began the week by trading above the 1.12 level mentioned last week. It then made an attempt to break 1.13 but retreated and fell sharply.

Technical lines from top to bottom:

1.1420 was a high back in the summer of 2016. 1.1360 capped the pair in September.

1.13 is the top line seen in November before the collapse. 1.1230 capped the pair in June.

1.1160 was a low point in May, where the pair retreated to after hitting new highs. The round number of 1.11 was a siwng low in late May.

1.1025 was the intial top after the pair breached 1.10 and now works as support. 1.0950 is close by, and the most recent 2017 high.

The swing high of 1.0870 is the swing high in December and remains fierce resistance. 1.0820 was the post-French elections low.

1.0775 capped the pair in January and remains of importance. 1.0720 was also high in January.

I remain neutral on EUR/USD

The Fed is more hawkish than previously thought and that comes after Draghi cast doubts about inflation. However, the tables haven’t totally turned against the pair. The better political environment in Europe and the strong growth provide support to the pair, and it can continue holding the high range.

Our latest podcast is titled Markets are finally moving – will it last?

Follow us on Sticher or iTunes

Safe trading!