US retail sales and inflation figures badly disappoint expectations. Will the Fed change its mind about raising rates?

Core CPI is down to 1.7% y/y, headline CPI fell to 2% y/y. Retail sales are down 0.3% and core sales miss with a slide of 0.3%. The control group remains flat against expectations for a rise.

The US dollar is certainly reacting: the greenback across the board.

Quick Analysis: Will the FED change its mind? USD could crash

Update: Fed raises rates, leaves dots unchanged & Yellen is optimistic – USD recovers

Currency reaction

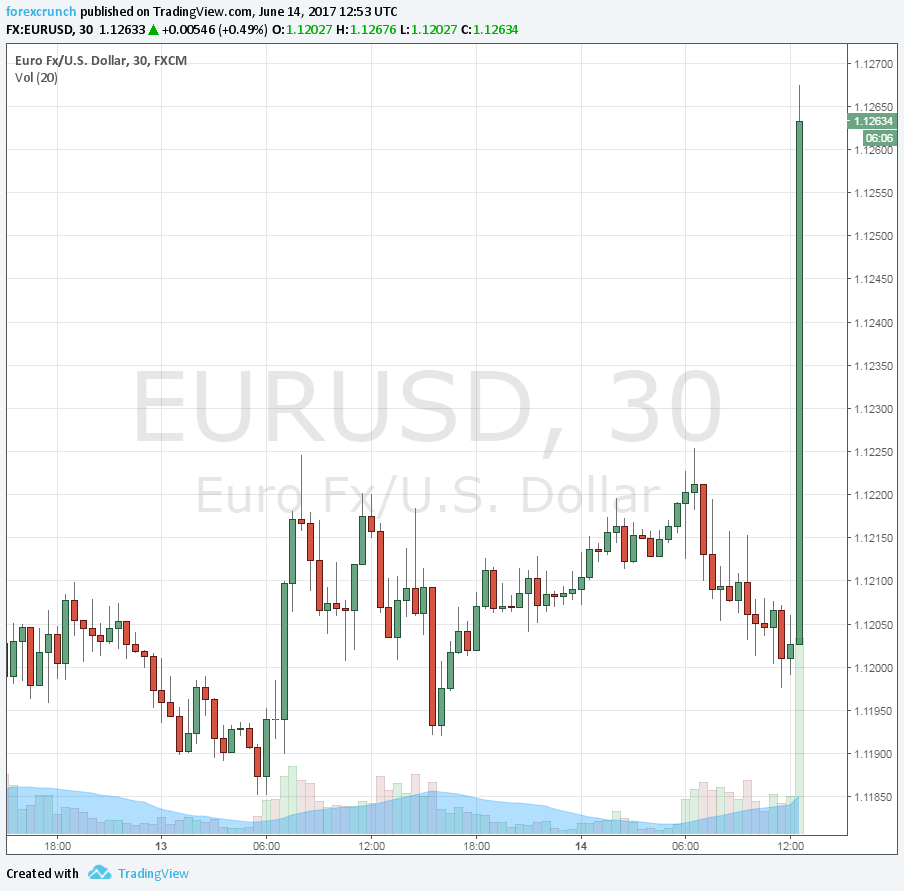

- EUR/USD is jumping from around 1.12 to 1.1250. Resistance awaits at 1.1284.

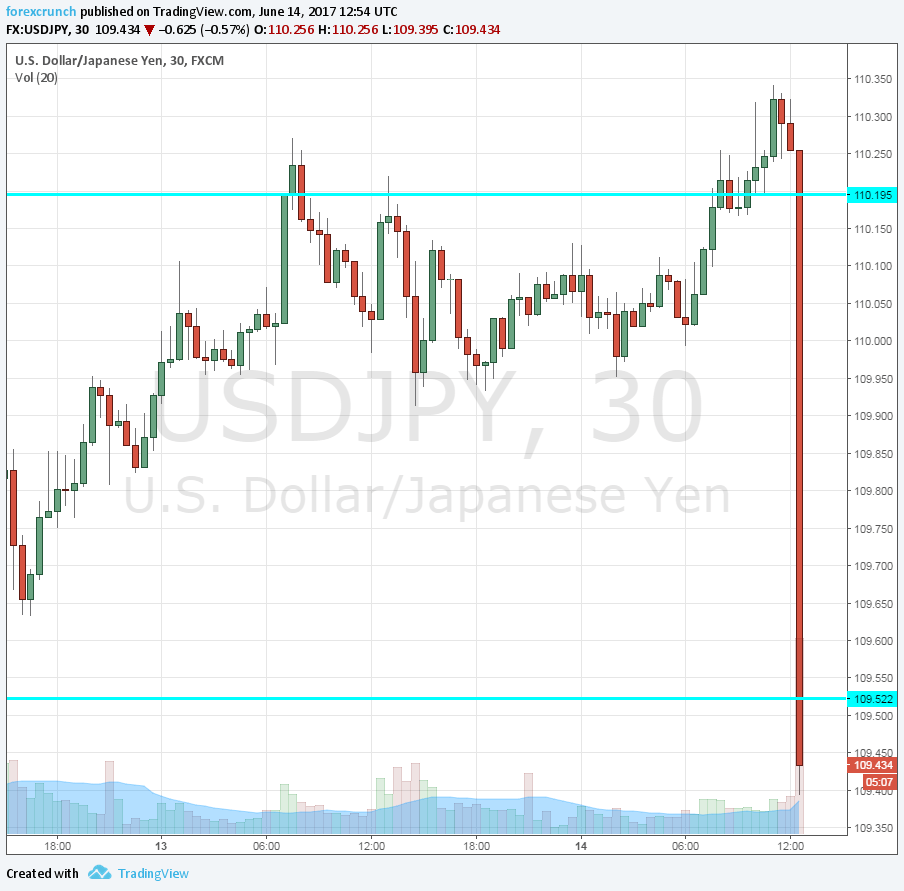

- USD/JPY is down to 109.70 from 110.30 beforehand.

- GBP/USD is up to 1.2770. Earlier in the day, the pound was hit hard by weak UK wages.

- USD/CAD is below 1.32, extending its falls to 1.3166. The hawkish tilt by Wilkins sent USD/CAD lower earlier in the week.

- AUD/USD is challenging resistance at 0.7610, extending its gain.

Here is how it looks on EUR/USD:

And also on USD/JPY, which experiences quite a drop:

The US reports inflation and retail sales numbers on the day the Fed makes its all-important decision. Core CPI was expected to rise at 1.9% y/y, the same as in April (before revisions). Retail sales carried expectations for +0.1% after 0.4% last month.

The US dollar was stable ahead of the publication, basically awaiting the Fed.

Inflation and retail sales May 2017

- CPI m/m: previous +0.2%, expected 0%, actual: -0.1%

- Core CPI m/m:prev. +0.1%, exp. +0.2%, actual: +0.1%

- Core CPI y/y: prev. 1.9%, exp. 1.9%, actual: 1.7%

- CPI y/y: prev. 2%, exp. 2.2%, actual: 1.9%

- Retail sales: prev. 0.4%, exp. +0.1%, actual: -0.3%, previous revised to 0.4%.

- Core sales: prev. +0.3%, exp. +0.2%, actual: -0.3%, previous revised to 0.6%.

- Retail control group: prev. +0.2%, exp. +0.3%, actual: 0%, previous revised to 0.6%.

The disappointing retail sales numbers are partially offset by upwards revisions. However, the slowdown in price development, especially the core CPI, is bad news for the Fed.

Awaiting the Fed

The Federal Reserve is expected to raise the interest rate once again despite an evident slowdown. This is the message they have sent and the FOMC does not like to rock the boat too much.

The big question is: what’s next? The path of interest rates, as well as the reduction of the Fed’s balance sheet, make a difference.

More: