The independent measure of China’s manufacturing sector, the Caixin manufacturing PMI, advanced above the 50=point threshold. At 50.4, the indicator not only returned to growth territory but also beat expectations that stood at 49.8 points for June.

The Australian dollar is unimpressed, trading under the round number of 0.77.

Why? China is Australia’s No. 1 trading partner and the indicator tends to have a strong impact. However, the accompanying statements state that inventory levels and confidence about future output, show that the rebound was probably temporary. Will it fall in July?

And the Chinese figure is not the only market-mover for the A$. Australian building approvals badly disappointed with a big fall of 5.6% m/m, much worse than a more modest slide of 1.3% predicted. Year over year, the number of consents plunged by 19.7%.

More: AUD: Domestic Vs External Drivers: Where To Target? – Barclays

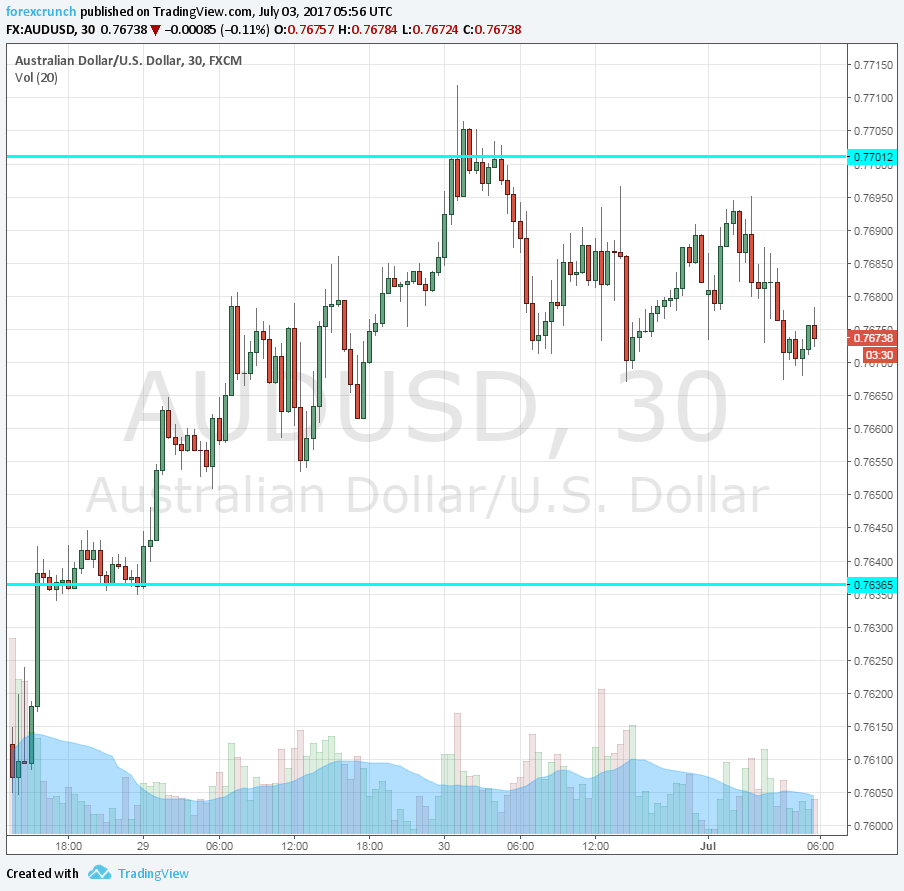

AUD/USD hesitant on high ground

The Australian dollar was cautiously grinding its way up, not really taking advantage of the weakness of the US dollar. At some point, the pair topped the 0.77 level but could not hold on this higher ground.

Resistance above 0.77 awaits at 0.7740. Support is at 0.7635, followed by 0.7590. Trading ranges are not huge, to say the least.