Benoît CÅ“uré, a member of the ECB’s executive board, said that so far, a change of policy has not been discussed. This does not sound like earth-shattering news but serves as a setback after Draghi’s Sintra Speech. There, the President of the ECB talked about the need to begin removing stimulus and sounded optimistic in general.

After Draghi’s speech, the ECB tried to downplay what was said there. The “clarification” sent EUR/USD swiftly lower, but the crash was merely a “flash” kind of crash, and the rebound was even quicker, with the euro eventually reaching higher ground.

This speech by Cœuré seems like another attempt to dampen expectations and perhaps dampen the strength of the single currency.

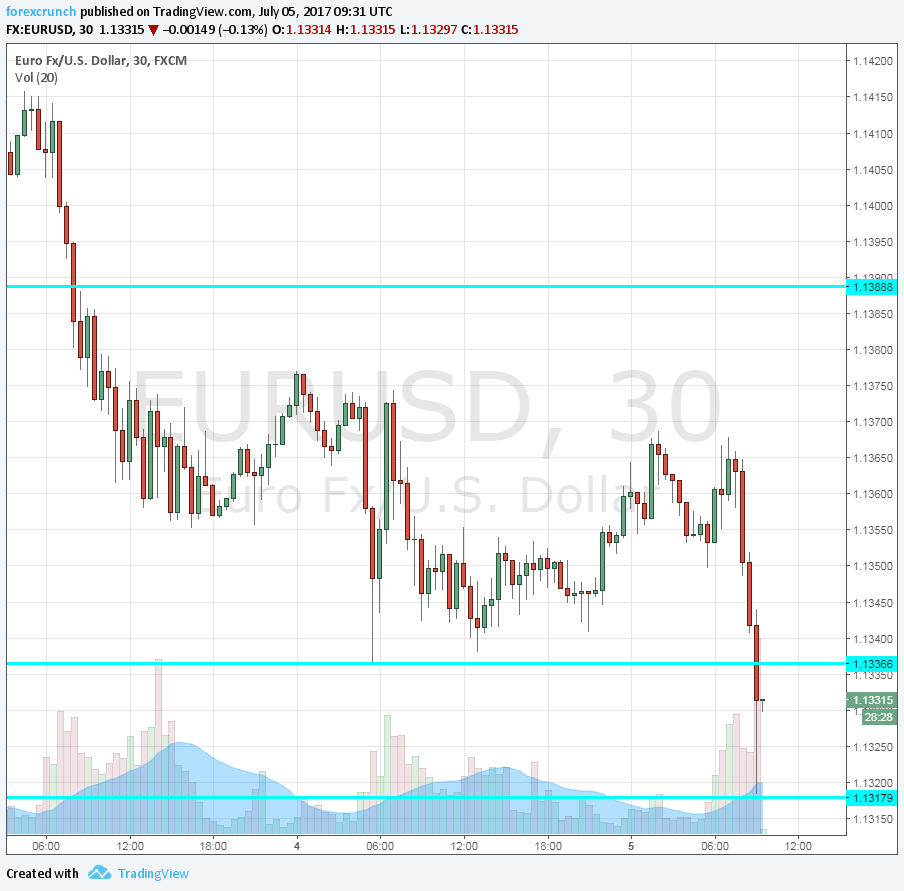

EUR/USD dropped from around 1.1365 to a new low of 1.1318, close to support at 1.13. After the initial drop, the pair is rebounding to 1.1330. On the way, euro/dollar slipped under 1.1335, which was the low seen yesterday.

All in all, the pair is in retreat mode this week. Last week, Draghi’s drive and some USD weakness sent it as high as 1.1445. This week is more favorable for the US dollar.

Here is how it looks on the EUR/USD 30-minute chart: