Draghi’s unconvincing dovishness and Mueller’s deeper dive into Donald Trump’s dealings are igniting another round of EUR/USD buying.

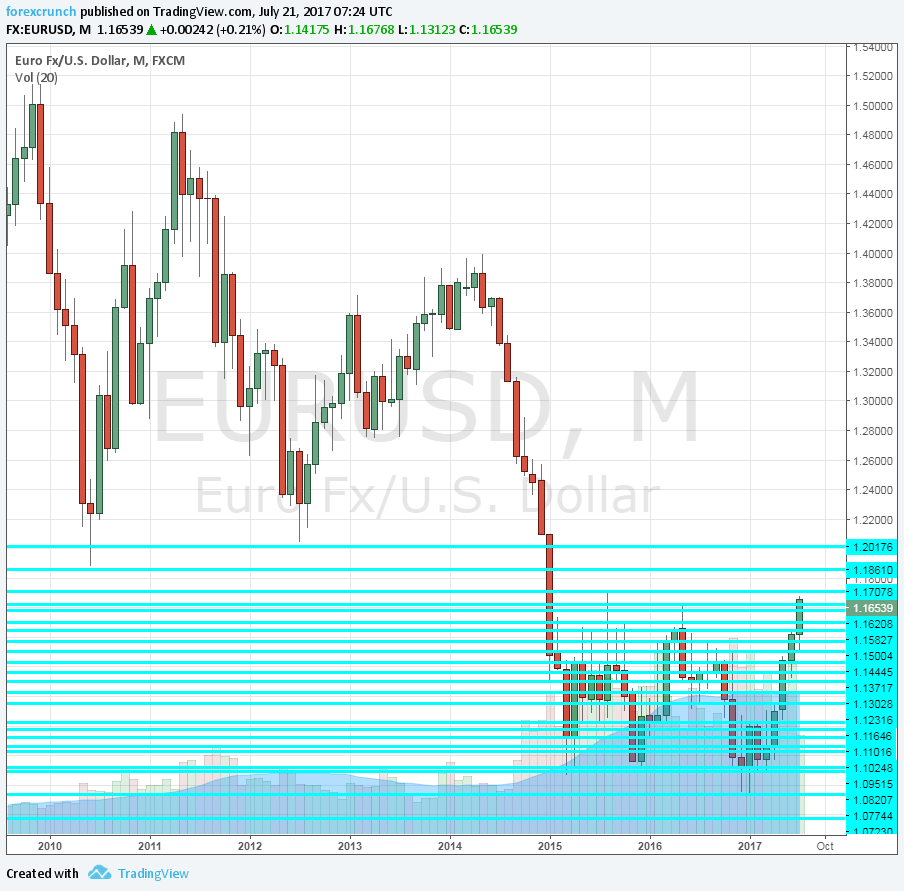

The world’s most popular currency pair is on the move again, topping yesterday’s high of 1.1656 and hitting a new peak at 1.1676. The 2016 high of 1.1620 is clearly broken after this second move.

And the next level of resistance is also close by. 1.1712 was the swing high seen in August 2015, when the Chinese stock market crashed and the euro temporarily served as a safe-haven currency. Some may say it is not a strong line as it wasn’t a stubborn point of resistance but just a very temporary high.

Nevertheless, 1.1712 is the highest point in nearly two years. If the pair breaks above this level, the pair would reach the levels traded just before Draghi announced the QE program in 2015, or more precisely, just ahead of the SNBomb which sent the euro tumbling down.

Beyond that swing high

1.1876 was a low point in 2010 and could be a stepping stone to the bigger prize of 1.20, an important psychological level of resistance and also the low seen in 2012, around Draghi’s “everything it takes” speech.

The common theme to the important turning points in the value of the single currency is the President of the ECB. Will he make further efforts to halt the ascent of the exchange rate? A rising exchange rate dampens inflation.

More: EUR/USD after the ECB: all the way to 1.20? Four opinions

Here is how it looks on the euro/dollar monthly chart showing the big levels on the pair: