Dollar/CAD eventually jumped higher on disappointing data from the Canadian economy, after initially weathering the strength of the US Dollar. The economic calendar is relatively light, leaving room for NAFTA headlines to have a greater say. Here are the highlights and an updated technical analysis for USD/CAD.

Canadian manufacturing sales rose by a robust 1.4% and foreign securities purchases stood at 6.15 billion, also above expectations. But the figures that made a bigger difference were inflation and retail sales. Slower inflation and a big drop in core retail sales sent the loonie sharply lower on Friday. In addition, the weak economic data came on top of comments from the top US Trade Representative, Robert Lighthizer. He said that NAFTA negotiations are “nowhere close” to completion, contrasting optimism from Canadian PM Justin Trudeau. In the US, 10-year bond yields rose to 3.13%, the highest since 2011, supporting the greenback. Upward revisions on American retail sales and other small beats on economic indicators served as excuses to buy the greenback.

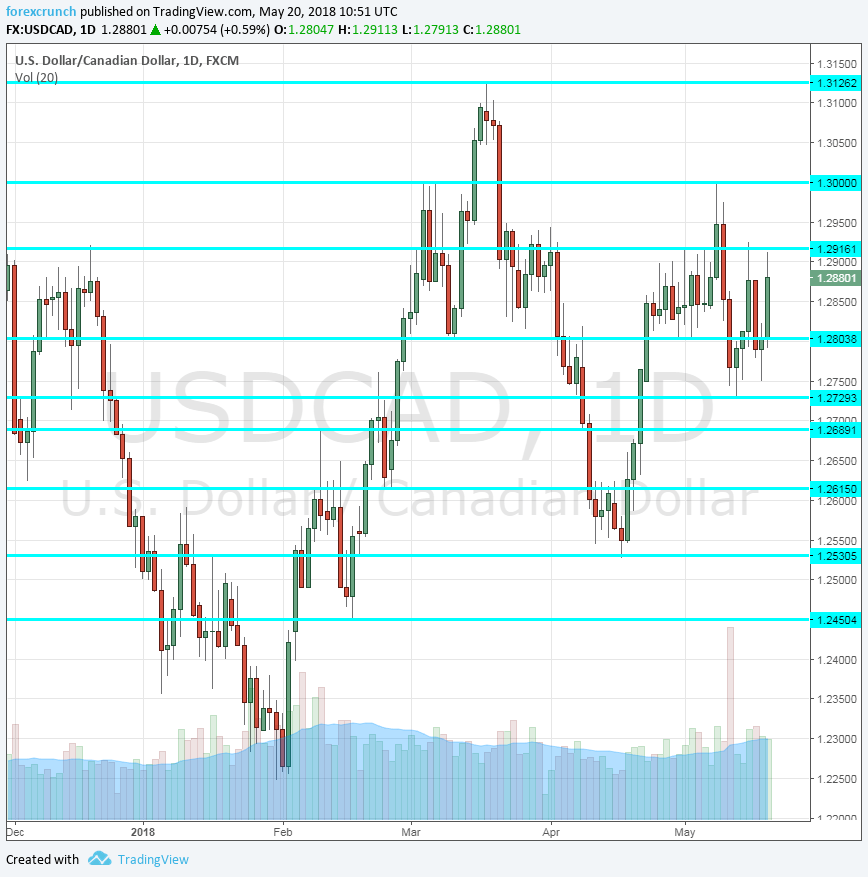

[do action=”autoupdate” tag=”EURUSDUpdate”/]USD/CAD daily graph with support and resistance lines on it. Click to enlarge:

- Wholesale Sales: Tuesday, 12:30. Sales at the wholesale level disappointed with a fall of 0.8% in February. A bounce with a rise of 0.9% is on the cards.

- Corporate Profits: Thursday, 12:30. Corporates saw a drop of 1.9% in profits in the last quarter of 2017, but this came after a leap of 8.5% in Q3 2017. We could see a rise now.

*All times are GMT

USD/CAD Technical Analysis

Dollar/CAD dropped towards 1.2730 (mentioned last week) but stalled a bit above that line.

Technical lines from top to bottom:

1.3180 was a support line in 2017 and now turns into resistance. 1.3125 is the high point for 2018 so far.

1.30 is a round number that is eyed by many. 1.2920 capped the pair in late April and early May as well. 1.2810 served as support in early May.

1.2730 was a swing low seen mid-May. It is followed by 1.2690 which was a swing high back in February. Further down, 1.2615 and 1.2535 where the top and bottom of a range seen in early April.

I am neutral on USD/CAD

The disappointing data is accumulating and it is hard to remain optimistic on the loonie. On the other hand, NAFTA is not priced in, so a surprise announcement on a deal could boost the C$.

Our latest podcast is titled Truce in trade and dollar domination

Follow us on Sticher or iTunes

Further reading:

- EUR/USD forecast – for everything related to the euro.

- GBP/USD forecast – Pound/dollar predictions

- USD/JPY forecast – analysis for dollar/yen

- AUD/USD forecast – projections for the Aussie dollar.

- Forex weekly forecast – Outlook for the major events of the week.

Safe trading!