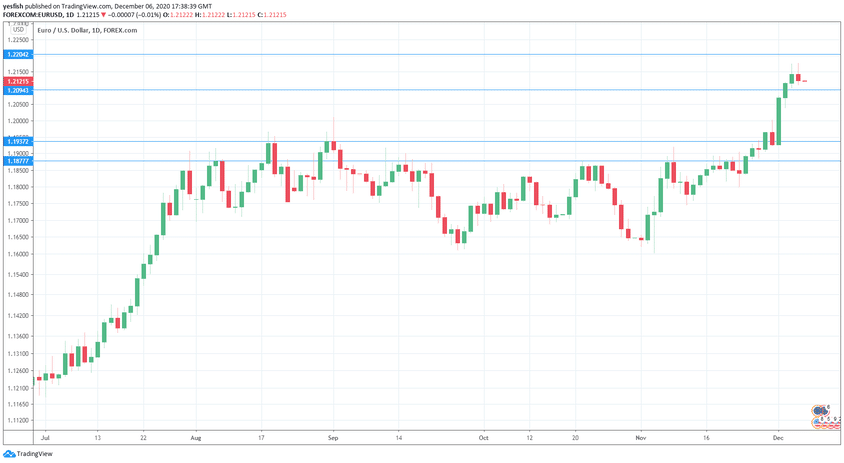

EUR/USD daily chart with support and resistance lines on it. Click to enlarge:

The US manufacturing sector continued to grow, as the ISM Manufacturing PMI came in at 57.9, although this was weaker than the previous release of 59.3 points. The ISM Services PMI fell to 55.9, down from 56.6 points. Still, this was a sixth straight month of expansion. In testimony on Capitol Hill, Federal Reserve Chair Powell reiterated his message for further fiscal stimulus support from the federal government. Nonfarm payrolls dropped to 245 thousand, down sharply from 638 thousand. This missed the estimate of 480 thousand. Wage growth surprised with a gain of 0.3%, above the estimate of 0.1%.

- German Industrial Production: Monday, 7:00. Industrial Production rebounded in September with a gain of 1.6%. The estimate for October stands at 1.8%.

- Sentix Investor Confidence: Monday, 9:30. Investor confidence remains mired in negative territory, which points to prolonged pessimism. Another weak reading is projected for December, with a forecast of -11.9 points.

- German ZEW Economic Sentiment: Tuesday, 10:00. The indicator has been falling fast and fell to 39.0 in November, which points to deep contraction. The December estimate stands at 45.2 points.

- ECB Rate Decision: Thursday, 10:45. The ECB holds its policy meeting later this week. The central bank is projected to add further easing, with analysts expecting an increase in the Pandemic Emergency Purchase Program by 400-600 billion euros.

- French Final CPI: Friday, 7:45. The eurozone’s second-largest economy has not been able to generate any inflation, and CPI came in at 0.0% in October. We now await the November data.

EUR/USD Technical analysis

Technical lines from top to bottom:

We start with resistance at 1.2484.

1.2329 is next.

1.2203 has held in resistance since April 2018.

1.2094 is protecting the 1.21 line.

1.1936 is the next support line.

1.1877 (mentioned last week) is the final support level for now.

.

I am bullish on EUR/USD

The euro continues to make inroads against the US dollar, as investors continue to give the greenback the cold shoulder. The euro has some strong momentum and the currency’s rally could continue this week.

Further reading:

- EUR/USD forecast – for everything related to the euro.

- USD/JPY forecast – projections for dollar/yen

- AUD/USD forecast – predictions for the Aussie dollar.

- USD/CAD forecast – Canadian dollar analysis

- Forex weekly forecast – Outlook for the major events of the week.

Safe trading!