- Gold remains poised to gain amid corona fears.

- US yields are dropping.

- Global data is not positive, raising demand for safe-haven.

Gold prices remained stable and continued to climb on Friday, while an eight-day rally in Treasury bonds ended amid fears of a global rise in new Covid-19 infections.

Spot gold rose 0.1% to $1804.91 an ounce, while US gold futures climbed 0.3% to $1804.95 an ounce.

The yield on 10-year US Treasuries increased 3.8 basis points after falling 14 basis points in the first four days of the week.

The yields on Germany’s 10-year bonds and other large eurozone government bonds also rose.

The US Dollar remained stable amid growing fears of the rapid spread of the Delta virus, which could put even more pressure on the economy; which also contributed to the sharp drop in share prices.

Investors did not ignore the news that the Biden administration plans to add ten Chinese companies to the blacklist.

-Are you looking for the best CFD broker? Check our detailed guide-

On the economic front, consumer price inflation in China eased in June, and production prices rose at a slower pace after the government stepped up measures to curb rising commodity prices.

The UK economy grew at a slower pace in May, despite easing restrictions related to COVID-19.

Gold price forecast: Key events to watch next week

Three key events can potentially bring volatility in the EUR/USD pair.

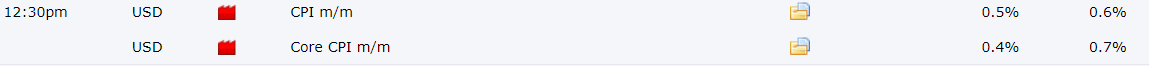

US core inflation

US core inflation figures are due on Tuesday. Although the inflation figures may weigh on the Greenback apparently it seems like the market has already discounted the effect of higher inflation.

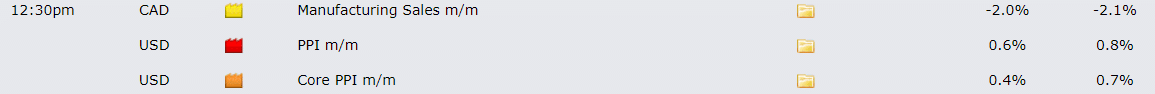

US PPI

US PPI

US PPI data is due on Wednesday, and it can impart a significant change in the pricing of the EUR/USD. We expect a positive release of figures.

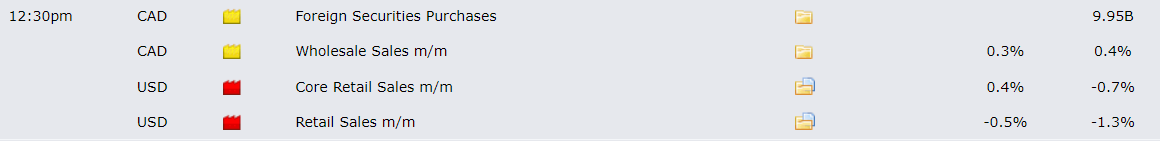

US retail sales

US retail sales figures are due on Friday. We expect a rise in US retail sales.

-Are you looking for forex robots? Check our detailed guide-

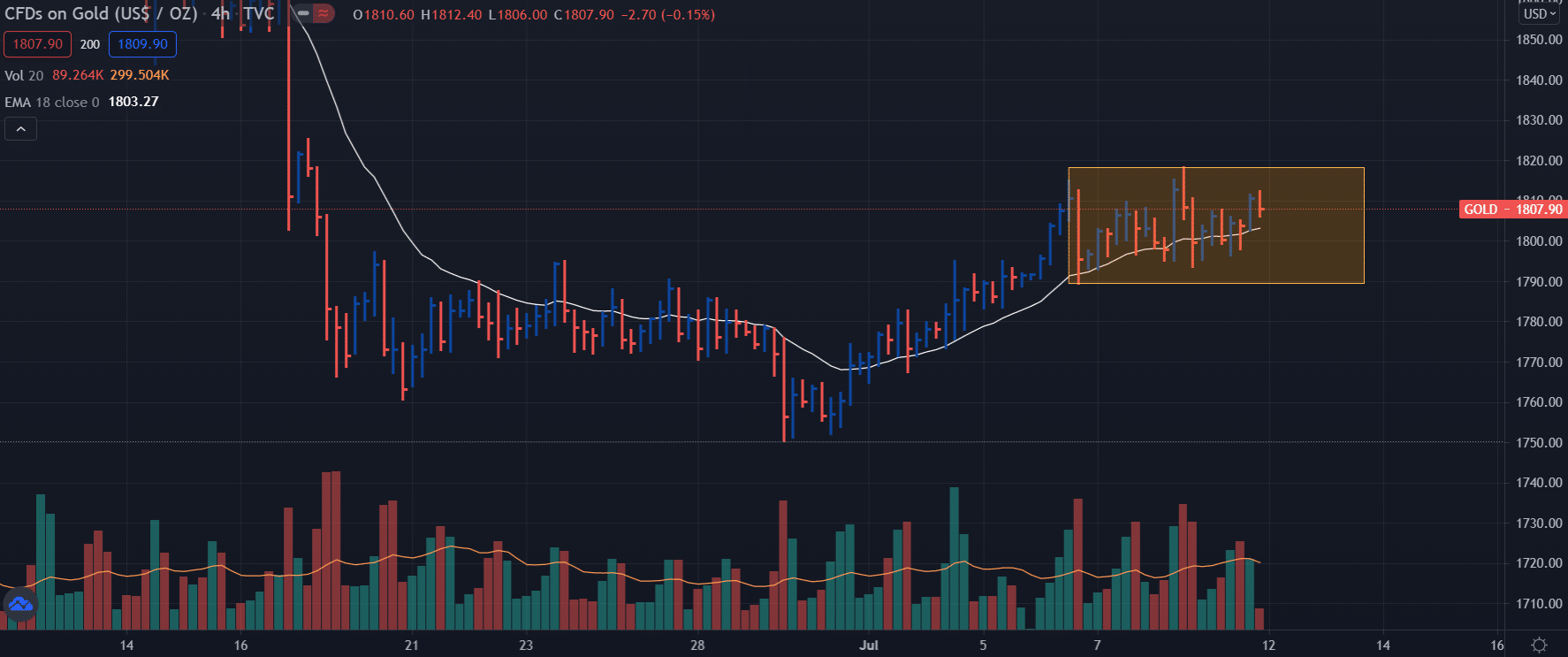

Gold price technical forecast for the week July 12 – 16

Gold price remains in the consolidation phase and looks for a catalyst to find the directional bias. Gold remains on the upside, beyond the 20-SMA on the 4-hour chart. The volume is near average which shows that there is no clear bias in the market. However, the path of least resistance lies on the upside. The initial target for the precious metal is $1844.

Looking to trade forex now? Invest at eToro!

67% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you can afford to take the high risk of losing your money.

US PPI

US PPI