- The NZD/USD could approach and reach fresh new highs as long as the DXY resumes its drop.

- The bias remains bullish as long as the pair is traded within the ascending channel’s body.

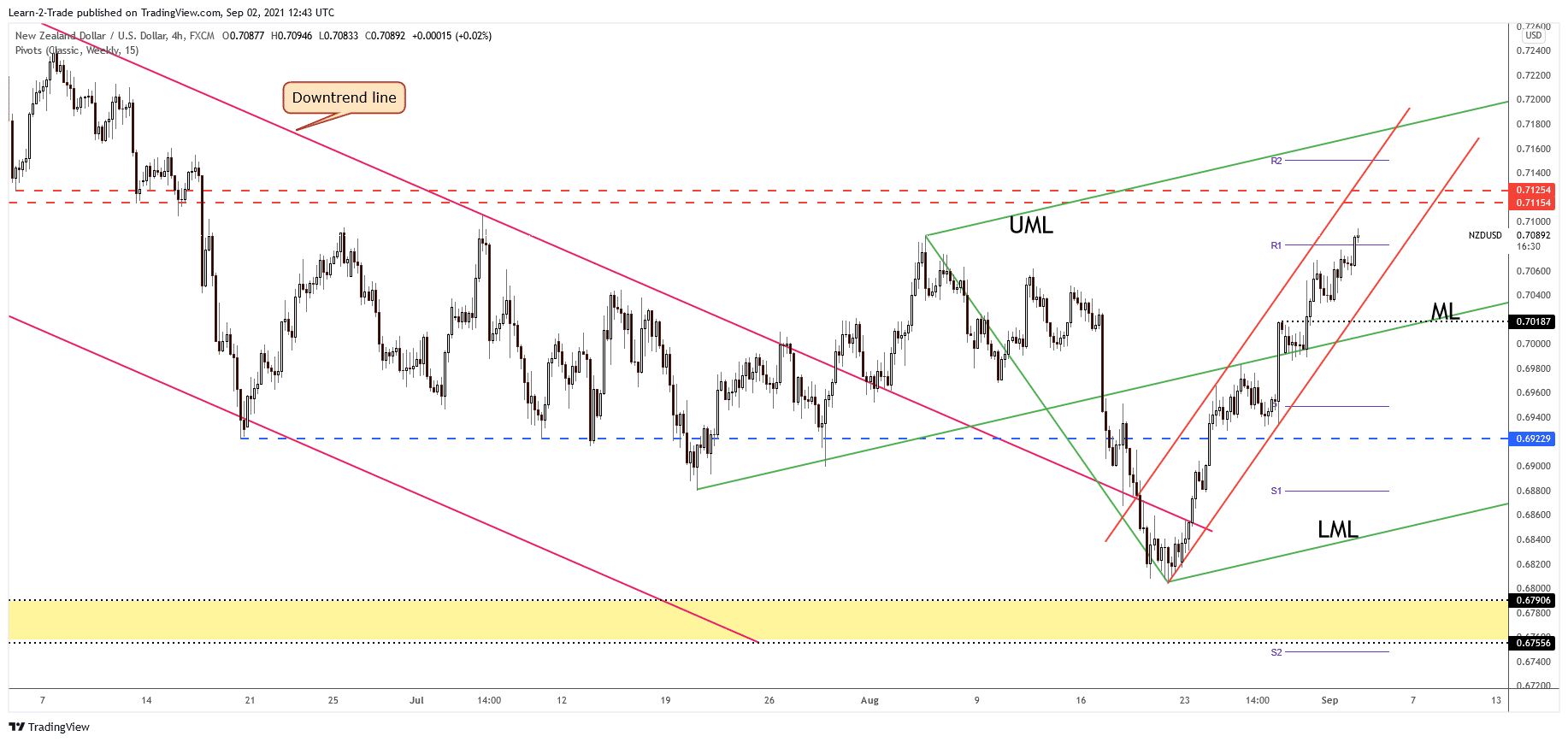

- The upper median line (UML) could attract the price after making a valid breakout through the median line (ML).

The NZD/USD price continues to increase even if the Dollar Index has found temporary support. The outlook is bullish as the price is trapped within an up-channel pattern. It could resume its growth as long as it stays within this formation.

–Are you interested to learn more about day trading brokers? Check our detailed guide-

The pair resumes the upward movement even if the United States data have come in better than expected. For example, the Unemployment Claims dropped from 353K to 340K in the last week versus 342K expected. In addition, the Trade Balance was reported at -70.1B below -70.7B estimate and compared to -75.7B, the Revised Nonfarm Productivity increased by 2.1%, below 2.4%, which is good for the USD. At the same time, the Revised Unit Labor Costs increased by 1.3%, beating 1.0% estimate.

The United States Factory Orders indicator will be released later and is expected to increase by 0.4% in August versus 1.5% in July. This could bring more volatility to the NZD/USD pair. Worse than expected, data could weekend the greenback.

Tomorrow, the Non-Farm Employment Change, Unemployment Rate, ISM Services PMI, and the Average Hourly Earnings will be decisive. Definitely, these high-impact events will shake all markets, so the sentiment could change.

NZD/USD price technical analysis: Uptrend channel remains intact

The NZD/USD pair is trading at 0.7104 level below 0.7106 today high. However, it’s strongly bullish after taking out the static resistance represented by the weekly R1 (0.7081) level. The next upside target stands at 0.7115 – 0.7125 resistance zone.

–Are you interested to learn more about forex signals? Check our detailed guide-

It has failed to come back to test and retest the uptrend line signaling strong buyers. Therefore, the upside line is seen as an upside target as well. Technically, the valid breakout through the ascending pitchfork’s median line (ML) signaled the current strong growth. From the technical point of view, the upper median line (UML) of the ascending pitchfork could attract the price as long as it stays above the uptrend line.

You should know that the upside scenario could be invalidated only by a valid breakdown through the channel’s support.

Looking to trade forex now? Invest at eToro!

67% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you can afford to take the high risk of losing your money.