- The NASDAQ Price Is In Bullish Territory This Morning As Markets Await FOMC Decision

- Brutal Losses Over the Past days Seems To Have Been Stemmed Somewhat With A 0.57% Increase For NASDAQ

- Uncertainty And High Inflation Forecasts Remain A Drag On The Markets In General

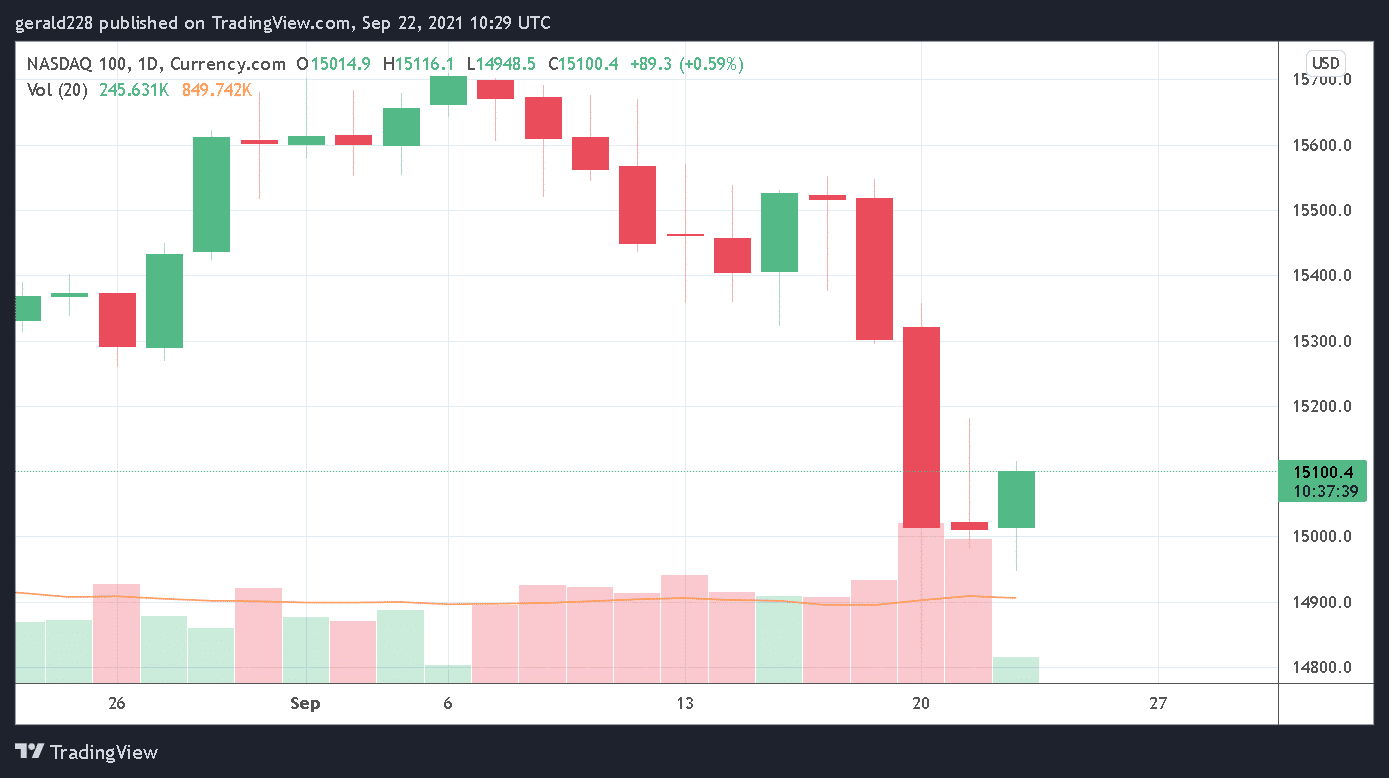

The NASDAQ price is up by around 0.57% this morning and is trading at around the 15100 mark. Although that is admittedly a far cry from its recent highs of around 15550 there is some hopeful optimism surrounding the upcoming FOMC decision where some indication of when the economic tapering of Covid19 support is about to start.

It’s also clear that US markets are contending with their own challenges in addition to the FOMC. The House of Representatives passed a vote to extend the US debt ceiling until after next year’s mid-term elections and will vote on a full bill today. It will most probably be dead on arrival in the US Senate though, with Mitch McConnell as much as saying so, forcing the process into reconciliation to pass.

The annoying gamesmanship over the debt ceiling from both sides should be another reason for the Fed to stay on the cautious side of things this evening. In the meantime, markets are still awaiting other developments.

If you’re interested in trading forex then you should have a look at this Forex Trading For Beginners Guide.

Short Term Prediction For NASDAQ Price: A Recovery On The Cards As Investors Get Back On Board

After four sessions in which the NASDAQ price dropped around 3%, it seems that the green shoots of a recovery are appearing. It seems that the Evergrande debacle is not such a disaster after all and investor confidence is getting back on the ground. With a healthy rise this morning, it seems that the FOMC decision will be the next indicator for the markets.

If a bullish scenario takes over, the NASDAQ price could once again start an upward trend with the 15200 level next on the cards. If market sentiment improves considerably then a push up to the 15400 mark would not be untoward. Much depends on the economic announcements which are coming out soon with the FOMC clearly taking pride of place.

If bears continue dominating, then we could expect a revisiting of the 15000 support level quite fast. If that breaks then the sell-off could be very brutal with large falls expected. However, this scenario looks quite unlikely at present.

If you want to start trading forex then take a look at these Top Forex Brokers.

Long Term Prediction For US100: Inflation and Economic Tapering Remain The Big Issues

With the NASDAQ price having recently taken a considerable hammering, the recent news that inflation was likely to continue on a high level for the rest of the year did not go down too well with the markets. Although the NASDAQ remains bullish long-term these issues as well as the much-vaunted economic tapering remains on the cards.

A cautious long-term prediction would be for the NASDAQ price to regain the 15500 level by October and with the economic recovery gathering steam, a push for the 16000 mark by end of year.

Looking to trade forex now? Invest at eToro!

67% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you can afford to take the high risk of losing your money.