- The Fed raised rates for a fourth time by a massive 75bps signaling more.

- The US added more jobs than expected in October.

- The unemployment rate in the US came in higher than expected at 3.7%.

The USD/CHF weekly forecast is bearish as a mixed US jobs report exposed the impact of the Fed’s aggressive hikes. This could mean smaller hikes in the future.

–Are you interested in learning more about CFD brokers? Check our detailed guide-

Ups and downs of USD/CHF

The pair had a slow start to the week but picked up on Wednesday. For the fourth time in a row, the U.S. central bank increased interest rates on Wednesday by three-quarters of a percentage point. The pair moved higher when Powell stated it was too early to consider a pivot because inflation was still high.

A mixed US jobs report brought on the sharp drop on Friday. In October, the United States added more jobs than was predicted. However, the rate of job growth is slowing. The unemployment rate rose to 3.7%, indicating that the labor market may loosen.

According to the survey of businesses, nonfarm payrolls rose by 261,000 last month, which was the smallest gain since December 2020.

Next week’s key events for USD/CHF

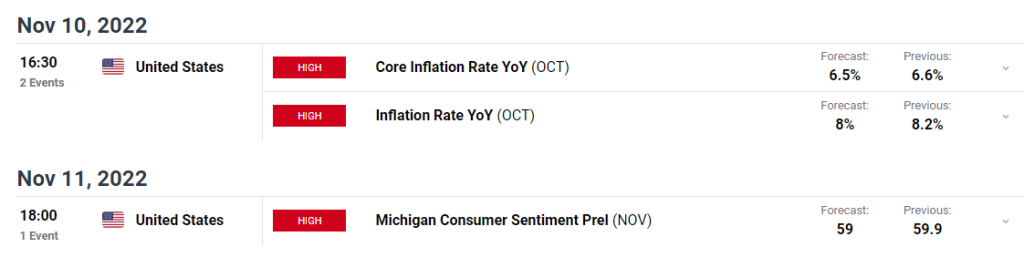

In the upcoming week, investors will closely monitor the US inflation figures. This will demonstrate whether the Fed is successful in controlling the inflationary pressure. The markets anticipate a decrease in inflation from 8.2% to 8.0%. A higher reading, though, might boost USD/CHF.

USD/CHF weekly technical forecast: Trendline support may break

The daily chart shows the price trading slightly below the 22-SMA and RSI slightly below 50. The bears have the upper hand but have still not fully taken over. The price was sharply rejected at the 1.0125 key resistance level. This can be seen in the bearish engulfing candle that went on to break below the SMA. The bears closed with a lot of momentum.

–Are you interested in learning more about MT5 brokers? Check our detailed guide-

However, the close came near strong support from a bullish trendline. The price will need to break below this trendline for the bearish move to continue. If bears fail to break below, we might see the return of bullish momentum. However, if the price breaks below, bears will look to take out the next support levels at 0.9852 and 0.9625.

Looking to trade forex now? Invest at eToro!

67% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you can afford to take the high risk of losing your money.