- The loonie weakened due to weak factory activity in Canada.

- Market expectations for Fed rate cuts in 2024 have reduced.

- Oil prices declined due to interest rate fears and reduced tensions in the Red Sea.

The USD/CAD price analysis paints a bullish picture as we launch into the 2024 trading landscape. The Canadian dollar’s descent against the dollar continues due to weak factory activity in Canada.

If you are interested in automated forex trading, check our detailed guide-

Notably, the Canadian S&P Global Manufacturing Purchasing Managers’ Index worsened on Tuesday, reaching a 43-month low. It reflects the ongoing deterioration in the Canadian economic outlook. Simultaneously, the US Manufacturing PMI component fell below expectations. As such, it kept market risk appetite low and supported the dollar due to risk aversion.

In December, the Canadian Manufacturing PMI hit a multi-year low of 45.4, down from November’s 47.7. Similarly, the US Manufacturing PMI for December recorded a four-month low of 47.9. It missed the market’s expectation of a steady reading from November’s 48.2.

Moreover, US Construction Spending experienced a decline in November, growing by 0.4% compared to the market forecast of 0.5%. However, October’s Month-over-Month Construction Spending print saw a substantial late revision from 0.6% to 1.2%.

At the same time, market expectations for Fed rate cuts in 2024 have reduced. Money markets are now pricing in a median of 150 basis points of rate cuts by the year’s end.

Additionally, the currency fell as oil prices declined due to interest rate fears and reduced tensions in the Red Sea. Canada is a significant exporter of oil. Therefore, a decline in oil prices hurts the Canadian dollar.

USD/CAD key events today

- The US ISM manufacturing PMI

- The US JOLTs job openings

- The FOMC meeting minutes

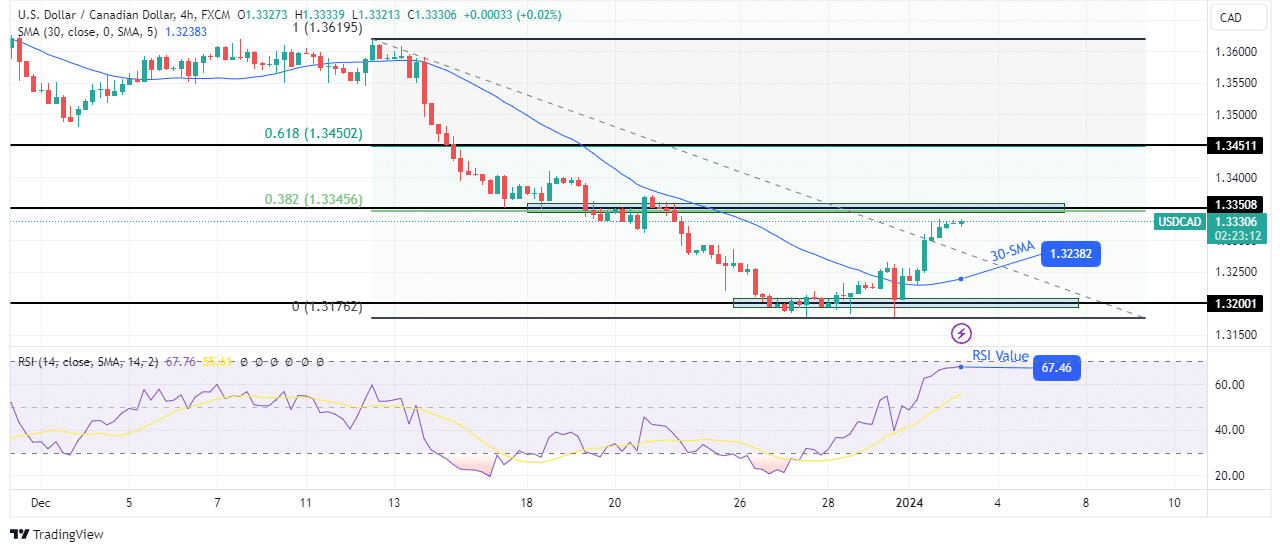

USD/CAD technical price analysis: Bulls rally from the depths of 1.3200 support

On the technical side, USD/CAD has recovered from its lows near the 1.3200 key support level. The bias is bullish as the price sits far above the 30-SMA, with RSI nearly overbought. The bearish trend reversed when the price got oversold, and bulls pushed the price above the 30-SMA.

If you are interested in guaranteed stop-loss forex brokers, check our detailed guide-

Currently, the bullish move is nearing the 1.3350 key resistance level. Additionally, there is resistance from the 0.382 fib retracement level. This makes a strong resistance zone that might lead to a pause in the bullish move. However, if the new bias holds firm, the price will only pull back before breaking above the resistance to continue the ascent.

Looking to trade forex now? Invest at eToro!

67% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you can afford to take the high risk of losing your money.