- Analysts expect the headline US inflation figure to have slowed to 0.3% in March.

- The likelihood of a Fed cut in June rose to 58%.

- Traders were preparing for the Bank of Canada policy meeting.

The USD/CAD forecast horizon appears shrouded in bearish sentiment as the dollar weakens due to a surge in rate-cut bets ahead of the US inflation report. At the same time, the Canadian dollar strengthened due to an increase in oil prices.

–Are you interested in learning more about buying NFT tokens? Check our detailed guide-

Investors were positioning themselves ahead of the US consumer inflation report. These figures will determine whether the Fed will cut interest rates in June. Analysts expect the headline figure to have slowed to 0.3% in March.

Notably, rate-cut bets increased before the report, with the likelihood of a cut in June rising to 58%. This figure is up from 52% on Monday and shows that investors expect a slowdown in inflation. At the same time, markets now forecast 74 bps of cuts in 2024.

On the other hand, the Canadian dollar was stronger on Wednesday as oil prices recovered. The deadlock in a Gaza ceasefire has caused a lot of worries about oil supply, pushing up prices.

At the same time, traders were preparing for the Bank of Canada policy meeting later in the day. The BoC will likely hold rates at 5%. However, traders expect a more dovish meeting after recent economic data.

Inflation in Canada has slowed down significantly. Similarly, the labor market has weakened, showing weaker economic demand. As a result, there is more pressure on the central bank to lower interest rates. Therefore, policymakers might signal the start of cuts in June.

USD/CAD key events today

- US Consumer Price Index report

- BoC monetary policy meeting

- FOMC meeting minutes

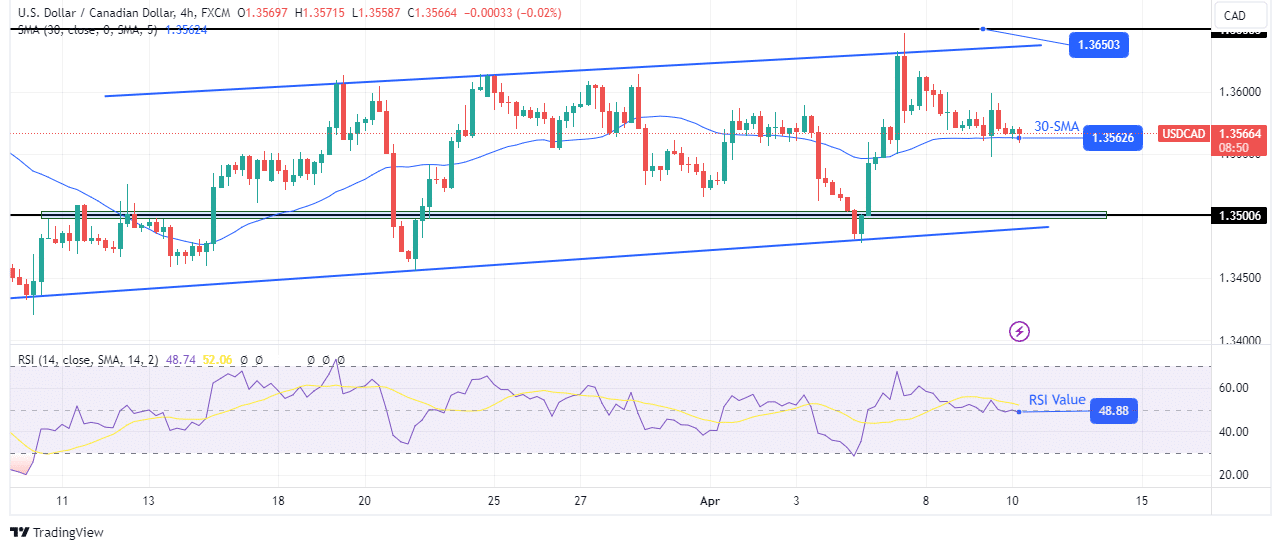

USD/CAD technical forecast: 30-SMA pauses decline to channel support

On the technical side, the USD/CAD price has paused at the 30-SMA support. Similarly, the RSI has fallen to retest the pivotal 50 level. However, on a larger scale, the price is in a shallow uptrend that keeps chopping through the SMA.

–Are you interested in learning more about British Trade Platform Review? Check our detailed guide-

Furthermore, it trades in a bullish channel with clear support and resistance. Therefore, since the price recently touched the resistance, there is a high chance it will fall to retest the channel support. Consequently, bears might target the 1.3500 level. Still, the price must break below the SMA for this to happen. Otherwise, it might rise to a new high.

Looking to trade forex now? Invest at eToro!

67% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you can afford to take the high risk of losing your money.